Tempe Arizona IRS Help: Collections Due Process Appeal?

Tempe AZ IRS Help

When a taxpayer and the IRS cannot come to an agreement regarding taxes owed or the settlement of how those taxes will be paid, Congress in 1998 enacted the Collection Due Process Appeal (CDP) process. A Tempe Arizona IRS Tax Attorney is not required to take this action. The IRS Appeals Office was set up to independently review the dispute when the negotiations between the IRS and taxpayer breakdown or when the taxpayer has ignored previous collection attempts by the IRS.

When the taxpayer receives his final notice to pay, they have 30 days to appeal the collection with a CDP Appeal. The Appeals office is interested in resolving the matter as quickly as possible. Many times it is in the best interest of the taxpayer to wait until they can petition the collection of taxes with the Appeals Office.

The Appeals Officer is willing to look at any settlement option that the law allows. Scott Allen E.A. is well versed in all the settlement options and the amount to be paid with each option. Scott will negotiate the best settlement the law will allow. Call Scott Allen E.A. at 480-926-9300 for a free consultation to evaluate filing a Collection Due Process Appeal and your settlement options. Before thinking you need a Tempe AZ IRS Tax Attorney give Scott Allen a call today!

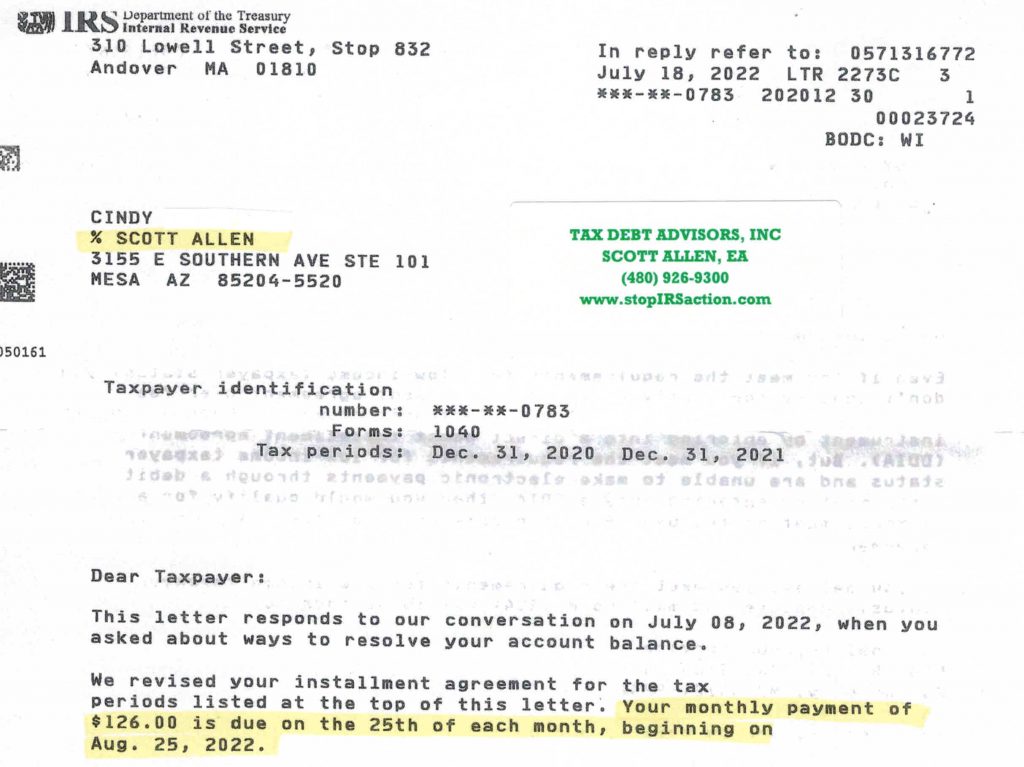

A taxpayer will have a lot of different options available to them when needing Tempe AZ IRS help. It could involve a CDP Appeal but often times it will not. It just requires timely follow through service and that is exactly what Scott Allen E.A. does provide. See what he did for his client Cindy. She found herself a couple years behind on paying her personal taxes. She didn’t need to file any appeals or challenge any IRS decisions. She just needed proper representation and negotiate the two years of back taxes into a low monthly payment plan.