Tempe IRS Bank Levy Release

Get your Tempe IRS Bank Levy Release

After the IRS has issued a levy on your bank account it is possible to accomplish a Tempe IRS Bank Levy Release. When the bank receive the levy notice from the IRS they will grab whatever funds are in the account at that time. They do not send it to the IRS right away; rather they hold the funds for 21 days. If they do not received a notice to release the levy within that 21 days the bank will forward those funds to the IRS as directed. It is important to know that the bank only “zaps” the bank account once per levy notice. They cannot keep “zapping” your bank account multiple times during that 21 day period.

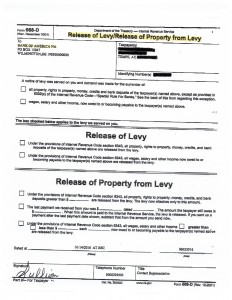

Tax Debt Advisors has experience in dealing with severe IRS issues that involve bank levies and garnishments. Below is a document showing a Release of Levy for a recent client that was in that 21 day window when he met with Scott Allen EA. Upon negotiations he was able to release the levy on his Bank of America account and settle up the debt in a payment plan.

If you have IRS debt or have unfiled tax returns give Scott Allen EA a call to schedule a convenient time to meet. Let him contact the IRS before they contact your bank account.