Wage Garnishment in Arizona: IRS help from Tax Debt Advisors, Inc

IRS help for Wage Garnishment in Arizona

What happens when the IRS garnishes my wages?

Your employer will receive a notice from the IRS to start sending a percentage of your pay check to the IRS. The amount that will be deducted from you check will vary depending on a number of factors including your filing status and number of dependents you are claiming. This is the maximum amount that the IRS can take. Your professional representative should be able to get this amount reduced by providing the IRS with information that shows a lesser ability to pay.

Most clients are shocked when their employer notifies them that their wages are now being garnished. However, few clients are surprised by the garnishment. In fact most have been expecting it to happen for months or even years. Prior notices requesting payment have usually been ignored.

What do I need to do to get my wage garnishment released?

First you have to be in compliance which means that all of your tax returns for prior years must be filed and you must be having the right amount of federal withholdings being deducted from your gross pay. I can file all of your back tax returns even if you have lost your tax records.

Second, the IRS will allow certain deductions against your net pay for reasonable living expenses—reasonable that is to the IRS. The IRS is not going to point out all the allowable deductions you are entitled to. The person you are talking to at the IRS is basically a bill collector. Their job is to collect as much as possible.

Before any amount is agreed to, I will make sure that you first understand all of your settlement options. There are pros and cons to each one but one is always better than the others. Sometimes I will use two or more options before a final settlement with the IRS is achieved. if all of your back tax returns have already been filed.

Once I have negotiated a settlement option with the IRS, the IRS will issue a garnishment release to your employer. This process is as much dependent on you as it is on the IRS. Providing accurate, complete and timely information will speed up the process. It is not uncommon to get garnishments released within 24 hours of providing the information requested by the IRS if all of your back tax returns have already been filed.

I guarantee that tax returns will be available the next day by 2 pm once I have all of the information needed to prepare your tax returns. This will be true whether you need to file one or 10 years. My office is not a doctor’s office where you have to wait for service—it is more like a MASH unit where you get immediate care. I know how important an hour or a day is to having a successful resolution to your tax debt.

If you are on “good terms” with your employer, it may be possible to get your garnishment released before the IRS actually takes some of your next pay check. This depends upon the amount of information requested by the IRS, number of back tax returns that need to be filed and a willingness of your employer to give you enough time to reach a settlement.

Recent success of stopping Wage Garnishment in Arizona for a client

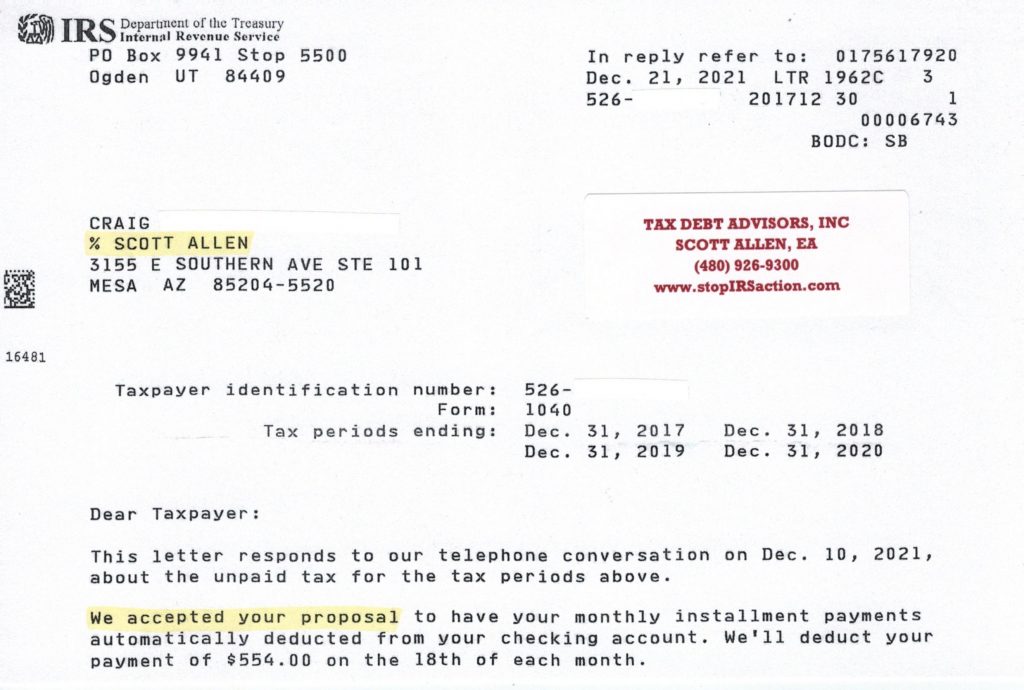

Craig was behind on four years of back taxes. The IRS was garnishing his wages and he needed it stopped quickly. The IRS was taking more then he could afford leaving him very little to pay his household bills. Scott Allen EA was able to represent Craig as his power of attorney, file his missing tax returns, stop the garnishment, and negotiate his total IRS debt into one low monthly payment plan. See for yourself by viewing the acceptance letter below.

Call me for a free initial confidential consultation today. – Scott Allen, E.A.

Mesa, Apache Junction, Avondale, Buckeye, Carefree, Cave Creek, Chandler, El Mirage, Fountain Hills, Gila Bend, Gilbert, Glendale, Goodyear, Komatke, Litchfield Park, Luke AFB, Paradise Valley, Peoria, Phoenix, Queen Creek, Scottsdale, Sun City, Sun Lakes, Surprise, Tempe, Tolleson, Waddell, Whitman, Wickenburg, Youngstown, Flagstaff, Tucson, Payson, Winslow, Sierra Vista, Page, Prescott, Globe, Yuma