We are Mesa Arizona’s Top IRS Problem Solvers for Statute of Limitations Issues

Mesa Arizona’s Top IRS Problem Solvers

If you feel you have a Mesa AZ IRS tax debt that has been in collections for a long time, it is possible to get information from the IRS that will tell you exactly when the tax debt will expire. Scott Allen E.A. has the expertise to advise you of all of your options to take advantage of having your IRS debt in Mesa Arizona expire under the statute of limitation rules. Scott Allen E.A. offers a free initial consultation.

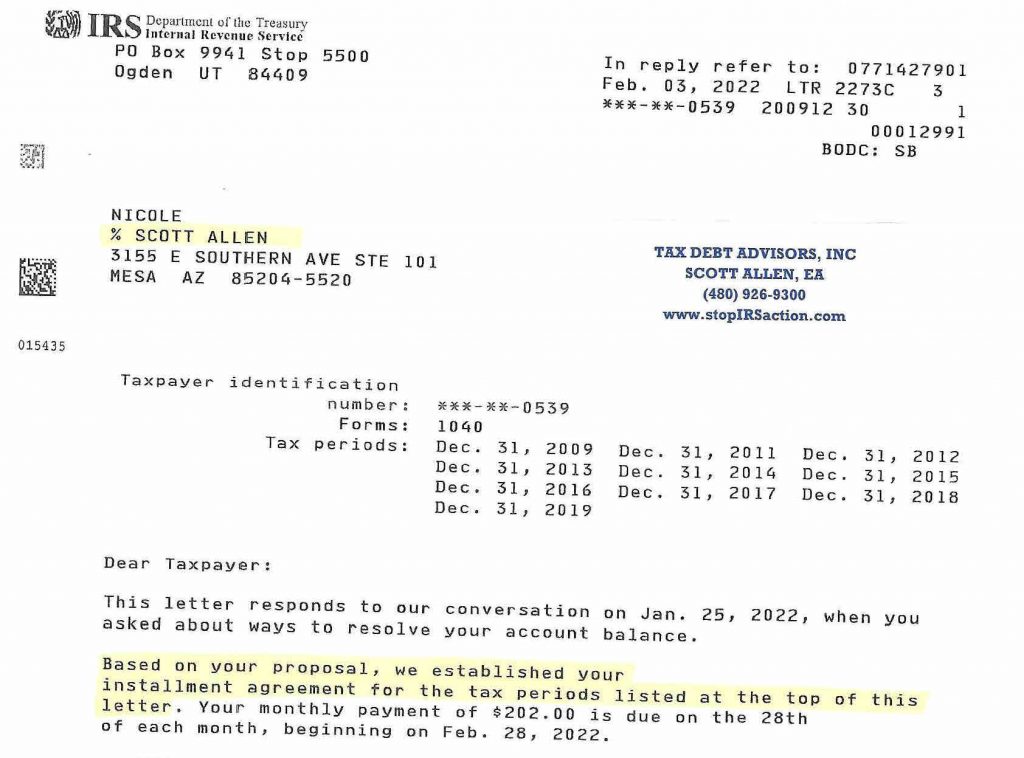

Scott Allen E.A. will often get asked if negotiating an IRS installment arrangement will add time to the statute of limitations. No, agreeing to an installment agreement for an old IRS debt will not add more time to the clock. That is exactly what was negotiated for Nicole and her ten years of back taxes owed ranging from 2009 thru 2019. Upon a detailed financial analysis Scott Allen E.A. knew he could negotiate a low $202 per month payment plan knowing full well that the debt will not be paid off before it expires. The IRS knows this as well. She will pay the $202 per month towards her back tax debt until they expire or get paid off (whatever comes first). Scott Allen E.A., one of Mesa Arizona’s top IRS problem solvers sees this happen all the time. This is why it is important to look at all the rules and options first before selecting one. View the IRS settlement agreement below for Nicole.