What happens when you file Mesa AZ back tax returns late ?

Mesa AZ Back Tax Returns

Scott Allen EA of Tax Debt Advisors Inc in Mesa AZ helps taxpayers with filing back tax returns.

One of the best ways to prevent your “future” IRS debt from growing is to file your tax returns on time. 90% of the penalties the IRS charges are from filing your taxes late NOT from not paying your taxes. Here are some of the negative things to be aware of if you file Mesa AZ back tax returns late.

If you fail to file your tax return on time the IRS can do what they call a SFR return meaning they file the taxes for you. They usually do this in a way that benefits them and gives you a rather large tax debt. If the IRS beats you to filing your taxes then those taxes can never be discharged in a bankruptcy. If you are a Mesa AZ taxpayers who usually qualifies for the Earned Income Credit; you forfeit the credit if you do not file within 3 years of the due date. Also, refunds expire after 3 years. If you are a self-employed individual and do not file within 3 years of the due date you will lose out on those social security benefits.

Although the law states the IRS can prosecute you for not filing your back tax returns in Mesa Arizona, as long as you don’t refuse Scott Allen EA has never seen this happen.

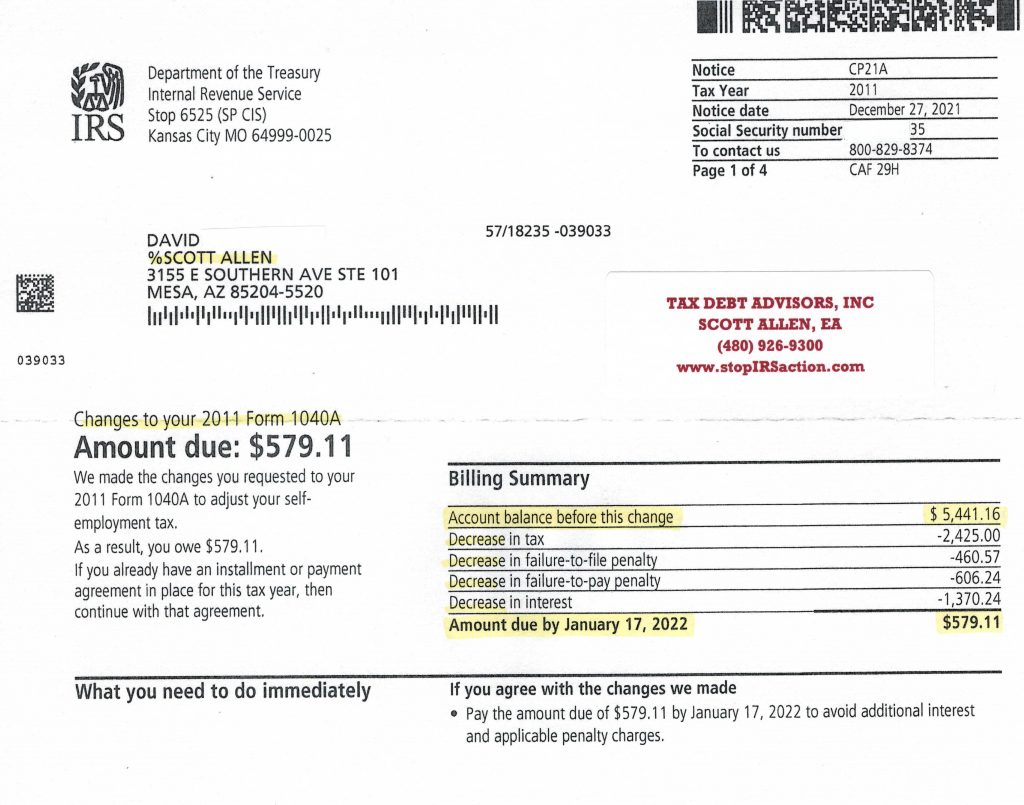

Check out the adjustment made on a 2011 tax return for their client David. He failed to file his 2011 tax return so the IRS prepared an SFR return causing him to owe over $5,000 in taxes in which he really didn’t owe. After meeting with Scott Allen EA they gathered up the necessary information to prepare an accurate return to protest the IRS. As you can see from the notice below that David really only owed the IRS less than $600.

With all that being said the best way to avoid large amounts of interest and penalties from piling on is to file your taxes on time. Whether you need help with tax preparation or filing back tax returns Scott Allen EA can get you on the right track. After everything is filed correctly and you have an IRS debt Scott Allen EA can also negotiate the best possible agreement or settlement allowable by law. Don’t delay any longer. Call 480-926-9300.