2017 Phoenix IRS Levy Release

In need of a Phoenix IRS Levy Release?

Thomas and his wife were both needing a Phoenix IRS levy release on their social security income. The IRS had been levying 15% of their social security income. That was over $600 per month being deducted from their “take home” pay.

Many taxpayers are unaware that the IRS can seize their social security income. But yes, they can and they do. In most cases the IRS is limited to only taking a max of 15% of that income however the IRS can go after 100% of it if they feel justified that the taxpayer is not trying to resolve ongoing issues.

What causes the IRS to issue these levies? Unpaid tax returns and unfiled tax returns. If you have one or both of these issues this is what Scott Allen EA specializes in. He can assist you from beginning to end in the entire process. He starts off by representing you before the IRS by signing over Power of Attorney to him. With the Power of Attorney Scott Allen EA becomes the point of contact. By representing you he can put a stop of any future negative action the IRS can take, prepare and file unfiled tax returns, negotiate settlements, and release IRS levies.

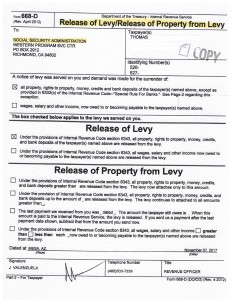

See a recent example of a social security levy released by Scott Allen EA just last week by viewing the image below.

Evaluate your options with the IRS by consulting with Scott Allen EA of Tax Debt Advisors, Inc. Find out what your rights and options are if you are under any type of levy or garnishment by the Internal Revenue Service.