2017 Phoenix IRS Settlement

View a 2017 Phoenix IRS Settlement by Tax Debt Advisors, Inc

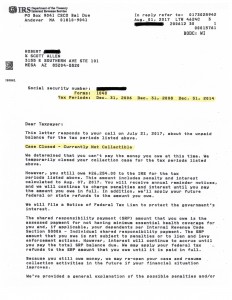

Today is August 4th and we just received notice of a 2017 Phoenix IRS settlement accepted by the IRS. Robert, a current client, was behind on a few years of tax returns in addition to the old back taxes owed. Over the course of several months Scott Allen EA prepared the unfiled tax returns for 2012 through 2016. This client was in the middle of a financial hardship. He was laid off from his previous employer, receiving unemployment, and searching for new employment. On top of all of that, the IRS was on his back.

Through proper procedures Tax Debt Advisors was able to navigate their way to a resolution. A currently non collectible status was negotiated with the IRS to cover his old tax debts. The exciting part of this all is that 90% of his total liability will expire with the IRS in just over two years from now. If he can ride out this settlement for two years Robert will not have to pay a single dime on his old debt with the IRS.

Currently non collectible status may not be the right solution for every taxpayer. Not every taxpayer will qualify for it either. For some it is a permanent solution and for others it is only a temporary solution until they get their life back on track. Have a consultation with Scott Allen EA at 3155 E Southern Ave #101 Mesa AZ 85204 to determine which of the five or six different settlement options may be right for you. After Scott Allen EA has gotten you caught up with your back taxes and settled your IRS debt he can also be your “regular” tax preparation guy moving forward. He will do everything he can to make sure you stay in compliance with the Internal Revenue Service so your agreed settlement does not default.