Enrolled Agent vs Gilbert AZ IRS Tax Attorney

Gilbert AZ IRS Tax Attorney or E.A. for IRS Resolution?

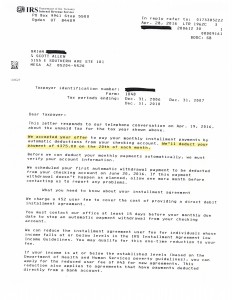

Instead of a Gilbert AZ IRS tax attorney, Brian used Enrolled Agent Scott Allen to resolve his tax debt. Tax Debt Advisors, Inc is a tax practice specializing in filing back tax returns and settling IRS debts and have been doing it since 1977. Scott Allen EA took over the family business from his father in 2006 and had been operating it fully ever since. Brian came in a met with Scott and reviewed his situation with him. Brian had five years of back tax returns to prepare. Scott reviewed with him the three step process to get a successful resolution.

First, Brain gave Scott Allen EA power of attorney to represent him before the IRS. With this he communicated with the IRS up front to analyze fully the situation at hand. Second, the five unfiled tax returns were prepared. And lastly, as you can see below a settlement was negotiated on the outstanding IRS debt. After all the tax returns were prepared Brian owed the IRS less then $25,000. They were able to establish a payment plan with the IRS and prevent them from filing a federal tax lien. All of this work from start to finish was handled by a family owned company headed up by Scott Allen EA (Enrolled Agent).

Nothing in this process was of a criminal nature requiring Brian to go and hire an expensive Gilbert AZ IRS tax attorney. He was simply delinquent. All delinquent IRS accounts can be resolved by a licensed Enrolled Agent with day-to-day experience in “fighting the IRS”. This is exactly what Scott does and can do for you. Meet with him today to find out if he is the right Enrolled Agent for you.

Thank you for taking time to read our IRS Help Blog.

December 2018 New Case Settlement

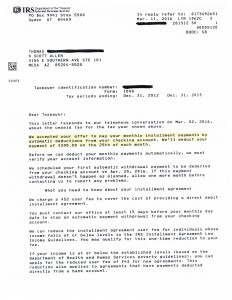

What can be done with an IRS debt of nearly $100,000? With an Enrolled Agent you can get it uncollectible. Yes, that is right. David owes the IRS $98,000 but does not have to make any payments on that debt. Scott Allen EA negotiated a uncollectible status. See the approved agreement below. The best part about this agreement is about half of the debt expires in less then two years. Many people don’t know IRS debts have a statute of limitations but they do.

If you have unfiled tax returns with the IRS or owe more then you can pay back (rather then paying an expensive Gilbert AZ IRS tax attorney) meet with Scott Allen EA. He will sit down with you for a free initial consultation to address your situation. Every client’s case is different but you deserve to get the best possible settlement allowable by law. Do not delay any longer. Call Scott!