Gilbert AZ IRS Tax Attorney to get an IRS tax lien released or removed?

Gilbert AZ IRS Tax Attorney

No, getting an IRS lien released is not a legal matter. If the IRS has filed a lien, it is important to know how long the Gilbert AZ tax lien has been filed. After the statute of limitations period of 10 years, IRS tax liens are automatically released. However, the IRS does not report this information to credit bureaus unless the taxes have been paid. Scott Allen E.A of Gilbert and Mesa can advised you how to get the credit bureaus aware that your lien is no longer in place.

If you have just had a lien filed and feel that it should not have been filed in the first place and did not take advantage of a Collections Due Process Hearing, contact Scott Allen E.A. and set up a free consultation to determine if you have a valid reason for the IRS to release the tax lien.

If the lien is not released, there are situations where the IRS will subordinate their lien to allow you to get a loan on your Gilbert AZ home. There are certain criteria that have to be met but if you qualify Scott Allen E.A. can get a subordination of your IRS tax lien. Instead of working with a Gilbert AZ IRS Tax Attorney contact Scott Allen E.A if you have a tax lien to determine what your options are. Scott can be reached at 480-926-9300.

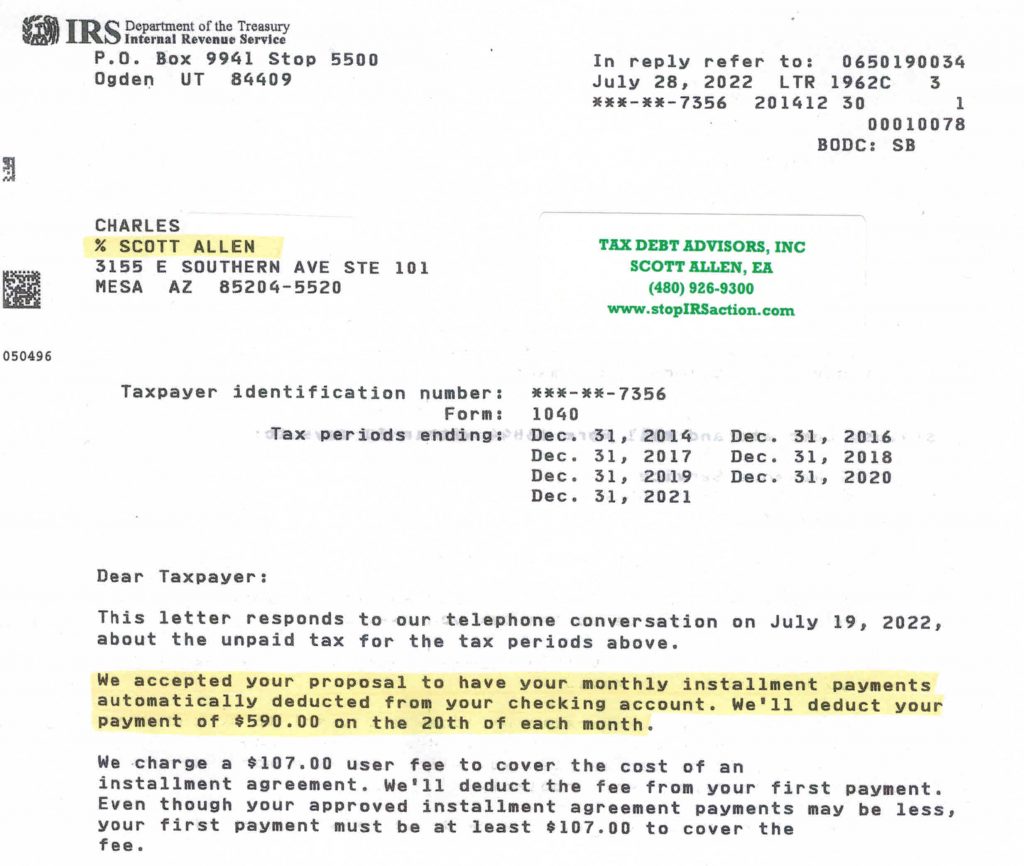

Charles came in to meet with Scott Allen EA to discuss his tax problem. He had some old IRS debt still hanging out there but also needed to file back tax returns for six years. Rather then hiring a Gilbert AZ IRS tax attorney he hired Scott (an Enrolled Agent) to represent him before the IRS. Scott Allen EA was able to stop garnishment action, prepare all six years of his back tax returns and prevent the IRS from slapping a tax lien on him. All of his IRS debt was negotiated into a low $590/month payment plan. With all this being handled for him he is now applying to by a home for himself. This is just one of the thousands of happy clients that have used Scott for IRS tax relief in Gilbert AZ.

Check out the IRS settlement letter for Charles below: