Do I need a Chandler AZ IRS Tax Attorney for IRS Tax Relief?

No, IRS tax relief is not a legal matter.

Chandler AZ IRS problems are a burden that often requires professional help but not necessarily require a Chandler AZ IRS Tax Attorney (as people in fear often assume). If you are delinquent in filing tax returns you need a Chandler AZ tax professional who is competent in both filing late returns and settling the debt associated with those back tax returns. Where taxpayers are hurt the most is in the amount the IRS expects to be paid back on a monthly basis. This is called an installment arrangement. An IRS professional with expertise in negotiating payment plans will minimize the amount you have to pay in monthly and often can get you qualified for no payment at all—this is referred to a currently not collectible status or CNC.

If you try to do this work yourself, you may find it difficult to get to the right person who can help you, and when you do find the right department you have to deal with a different person each time that often will come up with different conclusions about your settlement.

Scott Allen E.A. near Chandler Arizona knows in advance what the best settlement amount should be and is able to “manage” the IRS personnel towards that amount. The bureaucracy at the IRS is largely eliminated because Scott Allen E.A. is not a Chandler AZ IRS Tax Attorney but is allowed to talk with IRS personnel trained to deal with “practioners.” The rules that govern IRS settlements are not universal administered by IRS personnel. It is only at the manager or Appeals Office level that you get the person who can correctly agree to the settlement you are entitled to. Call Scott Allen E.A. for a free consultation at 480-926-9300 and bypass the bureaucracy, complexity and human error that are inherent in IRS settlement work. Let Scott make today a great day for you.

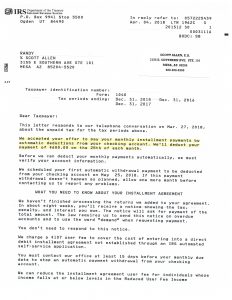

Update with another IRS settlement completed:

By viewing the letter above you can see the work accomplished by Scott Allen EA of Tax Debt Advisors. As an Enrolled Agent, Scott can do the same work a Chandler AZ IRS tax attorney and can deal with matters of tax preparation and collections. Randy was a struggling taxpayer who used a “less then average” tax preparer and got audited for in accurate expenses to put it nicely. Scott Allen EA was able to represent the taxpayer in the audit process, prepare his current tax return accurately, and negotiate a settlement on the remaining balance due. Get your first or second opinion on your current tax matter by sitting down with Scott Allen EA today. He will make today a great day for you!