Stopping Mesa AZ IRS Garnishments since 1977

What do I do when I have Mesa AZ IRS Garnishments on my wages?

This is about the most shocking thing the IRS can do to get your attention. That is what the IRS is trying to go with Mesa AZ IRS garnishments. They really don’t want to take your paycheck but because you have neglected all their letters and notices, now they want you to know they mean business. If you have not filed any Mesa AZ back tax returns, now is the time to do so. By filing correct returns, you may even reduce the liability the IRS says you owe. Filing all of your past tax returns is referred to at the IRS as being in compliance.

Tax Debt Advisors, Inc is a local Mesa Arizona family owned company for the last 40+ years that specializes specifically in IRS problem matters. We prepare tax returns and evaluate all settlement options that are available to you. Scott Allen, EA is fully licensed to represent taxpayers before the IRS. It is not necessary to use a tax attorney except of matters of fraud or criminal. 99% of IRS problem cases in Mesa AZ are not of criminal or fraudulent nature. Don’t overpay for the 1% of protection that you don’t need. This is our niche and this is all that we do. For a free no pressure consultation call me today.

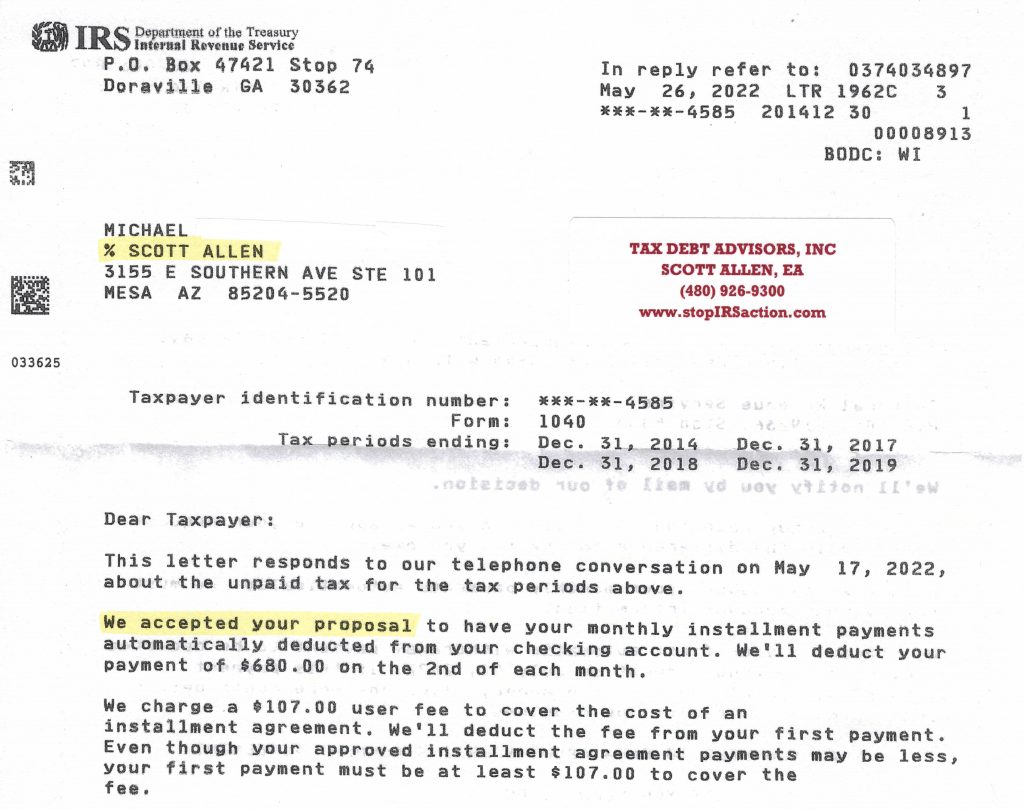

See what Scott Allen EA did for his client Michael to stop Mesa AZ IRS garnishments. He was able to settle his four years of back taxes owed into one monthly payment plan of $680/month. This agreement was negotiated so that the IRS would NOT file a tax lien either. A tax lien becomes public information and Michael did not want this.