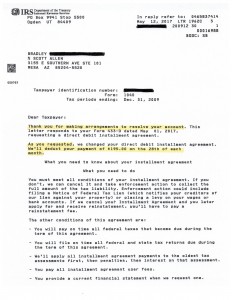

Mesa IRS Payment Plan: May 2017

Mesa IRS Payment Plan by Scott Allen EA

View the Mesa IRS payment plan notice below. Brad came in to visit with Scott Allen EA to discuss his current situation with the IRS. He had already negotiated a $750/month payment plan on his own. After a brief analysis Scott had determined that Brad could qualify for a much lower monthly payment amount and still not have the IRS file a federal tax lien. And, as you can see Brad is now on a direct debit payment plan of only $195/month.

An IRS payment plan is a common way, but not the only way to resolve an IRS debt situation. Other options can include a non collective status, offer in compromise, innocent spouse, tax bankruptcy, and so forth. Every settlement option has something good about it and something not so good about it. It is important to know what those are before making an agreement with the IRS. Scott Allen EA of Tax Debt Advisors will be sure you are aware of all of those first.