Mesa IRS Debt Help: Nov 2017

Mesa IRS Debt Help for Arizona taxpayers

Earlier this week Richard received Mesa IRS debt help from Tax Debt Advisors. He was just recently out from a Chapter 7 bankruptcy and need to resolve this IRS debt that been nagging on him for a little while now. Through the bankruptcy process he was able to get all his personal debt cleaned up except this IRS debt. Because its a recent liability it could not be included in the bankruptcy discharge unfortunately.

Richard is currently in a hardship situation in a new lower then expected paying job. After looking at all of his income and expenses it was very noticeable that he could not afford to pay the IRS very much. Upon a detailed review and negotiation process Tax Debt Advisors got Richard into a currently non collectible status for his IRS settlement. What does this mean? It means he does not have to pay anything on his IRS debt at this time. As long as he files and pays his future tax obligations timely this agreement should not default. If his financial situation changes for the better then the IRS at that time could request to take a look at his finances to see if he can start paying a monthly payment. If the IRS chooses to re-review a case its usually not more then every 2-4 years on average.

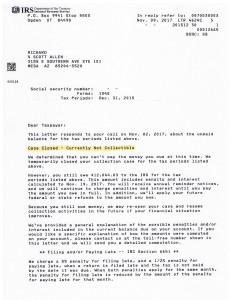

See Richard’s approval letter from the IRS of his approved settlement.

Meet with Tax Debt Advisors so you can evaluate your financial/tax situation with them. They will show you the process and step towards a successful resolution.