File Back Tax Returns in Gilbert

Scott can file back tax returns in Gilbert

If you forget or fail to file back tax returns in Gilbert the IRS can file returns for you. Yes, you read that correctly. The IRS will gather whatever income information that can on you and submit a tax return for processing and assess you a balance due. They will do this usually three to seven years after the tax return was due and after sending the taxpayer several warning notices. If you don’t recall receiving any of these notices the IRS could be sending them to your last address on record which could be pretty old depending on the last time you filed a tax return. It is always better to take care of back tax returns before the IRS gets it to this level that way there isn’t protest work involved. Either way, Scott Allen EA of Tax Debt Advisors, Inc can file back tax returns in Gilbert for you. He will speak to the IRS throughout the entire process so you do not have to.

Have you maybe lost some of your tax and financial records in order to file back tax returns in Gilbert accurately? Scott Allen EA can also help with that process as well. As your IRS Power of Attorney he can help retrieve as much information from the IRS as possible.

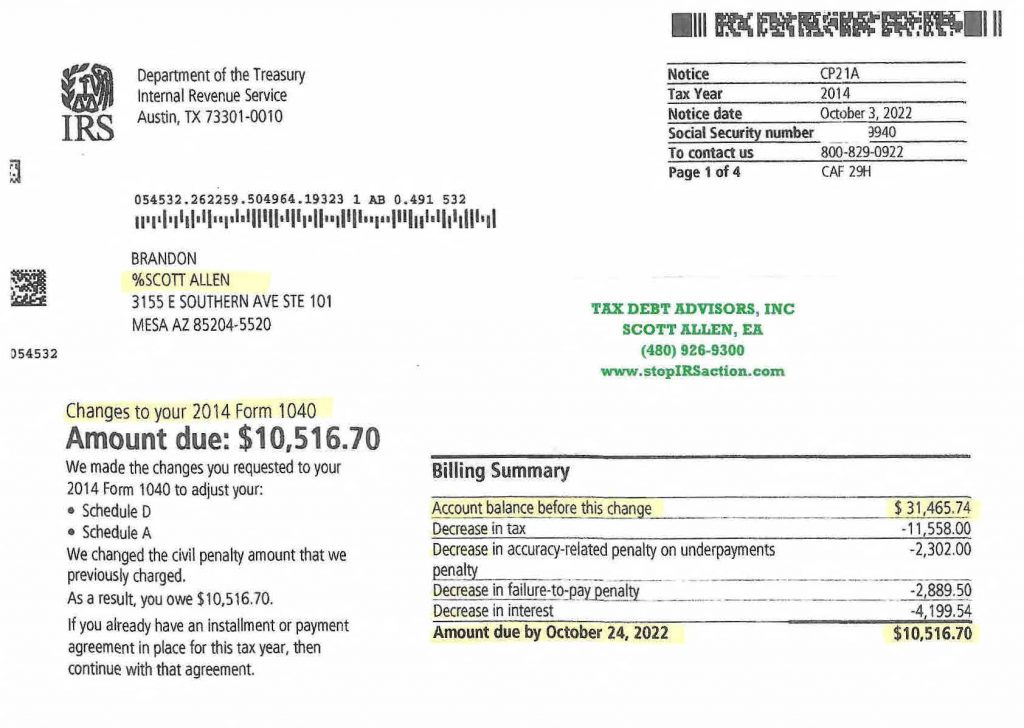

Scott Allen EA has a recent client, Brandon who was behind in some Gilbert back tax returns. One of those years being 2014. This IRS filed and made their own assessment that totaled over $31,000 in back taxes owed. This was outrageous. Upon an investigation into the account Scott Allen EA discovered that the IRS grabbed all the taxpayer’s gambling winnings and included it as income. The IRS didn’t know about or take into account any of the taxpayer’s gambling losses. Brandon then went and gathered up his casino and bank records to support deducting gambling losses. The tax law allows you to deduct your gambling losses up to a taxpayers winnings. Scott Allen EA prepared a 2014 return to protest the IRS’s Substitute For Return (SFR). Upon its full acceptance over $21,000 of taxes, interest, and penalties was removed. Check out the IRS acceptance letter below.

It is always important to do a complete review of a taxpayers account before negotiating a payment plan, non collectible status, offer in compromise, filing a tax bankruptcy, or file back tax returns in Gilbert. Scott Allen EA can assist and represent you before the Internal Revenue Service from start to finish. Give him a call today.