Local Enrolled Agent stops IRS levy in Mesa Arizona

Stop IRS Levy in Mesa, Arizona: Get Help From a Local Enrolled Agent

Living in Mesa, Arizona, and facing an IRS levy? You’re not alone. Thousands of residents deal with tax debt and the threat of IRS collection actions. But there’s good news: you have options to stop an IRS levy in Mesa AZ and get back on track with the IRS.

This blog post is about Scott Allen EA, a licensed Enrolled Agent at Tax Debt Advisors, Inc., a family-owned business serving Mesa and the surrounding area. As an Enrolled Agent (EA), Scott is a federally authorized tax professional with the same rights and privileges as CPAs and attorneys when representing taxpayers before the IRS https://www.irs.gov/tax-professionals/enrolled-agents/enrolled-agent-information.

Understanding IRS Levies

An IRS levy is a serious collection action. It allows the IRS to seize your wages, bank accounts, or other assets to satisfy your tax debt. Receiving an IRS levy notice can be a frightening experience, but it’s important to stay calm and take action immediately.

Case Study: How Scott Allen EA Helped Chris Stop an IRS Levy in Mesa

Chris, a resident of Mesa, recently contacted Tax Debt Advisors in a panic. He had received an IRS levy notice threatening to seize his wages. Chris hadn’t filed his tax returns for several years and owed a significant amount of back taxes. He needed help fast to stop the levy and avoid further financial hardship.

Scott Allen EA took charge of Chris’s case. Here’s what he did to help:

- Filed Missing Tax Returns: The first step was to file all of Chris’s missing tax returns. This ensured accuracy in the tax debt amount and opened the door for negotiation.

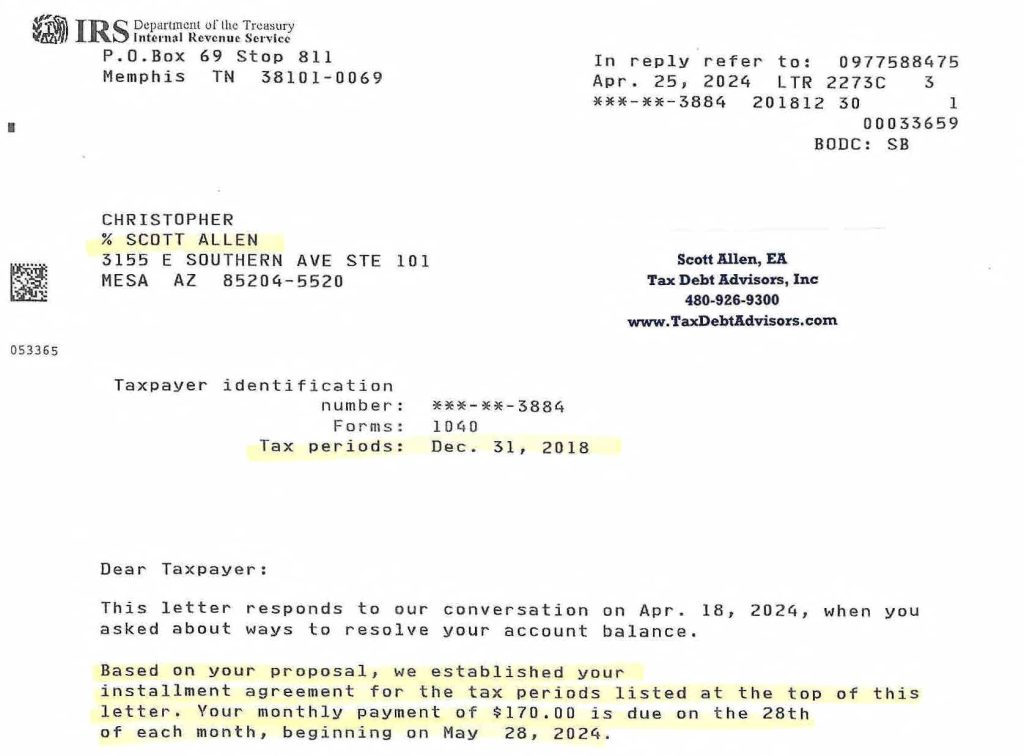

- Negotiated an Installment Agreement: Scott negotiated with the IRS on Chris’s behalf. He was able to secure a favorable installment agreement, allowing Chris to pay off his back taxes in manageable monthly installments of $170.

- Stopped the IRS Levy: With the installment agreement in place, Scott successfully stopped the IRS levy. This meant Chris’s wages and bank accounts were safe from seizure.

The letter from the IRS on the settlement approval for Chris is below for you to view. This is a real testimonial!

How Scott Allen EA Can Help You Stop an IRS Levy in Mesa

If you’re facing an IRS levy in Mesa, Arizona, Scott Allen EA at Tax Debt Advisors, Inc., can help. With his extensive experience and proven track record, Scott can handle all aspects of your case, including:

- Understanding Your Tax Situation: Scott will thoroughly review your tax records and analyze your options.

- Filing Delinquent Tax Returns: He will ensure all your missing tax returns are filed accurately.

- Negotiating with the IRS: Scott will advocate for you with the IRS to explore solutions like installment agreements or offers in compromise.

- Stopping IRS Collection Actions: His goal is to stop the IRS levy and prevent further collection actions.

- Protecting Your Assets: Scott will work tirelessly to protect your wages, bank accounts, and other assets from seizure.

Schedule a Free Consultation Today

Don’t wait until the IRS takes more aggressive action. Taking control of your tax situation now can save you significant stress and financial hardship.

Scott Allen EA offers a free consultation to discuss your specific situation and answer any questions you may have. He can be reached at 480-926-9300 or by visiting the Tax Debt Advisors website at www.TaxDebtAdvisors.com.

Remember, you are not alone. With the help of a qualified Enrolled Agent like Scott Allen EA, you can stop IRS levy in Mesa, Arizona, and get back on track with the IRS.

This blog post is for informational purposes only and should not be considered tax advice. Every tax situation is unique, and it’s crucial to consult with a qualified tax professional to discuss your specific circumstances.