Back Tax Returns in Phoenix

Do you have problems with Back Tax Returns in Phoenix?

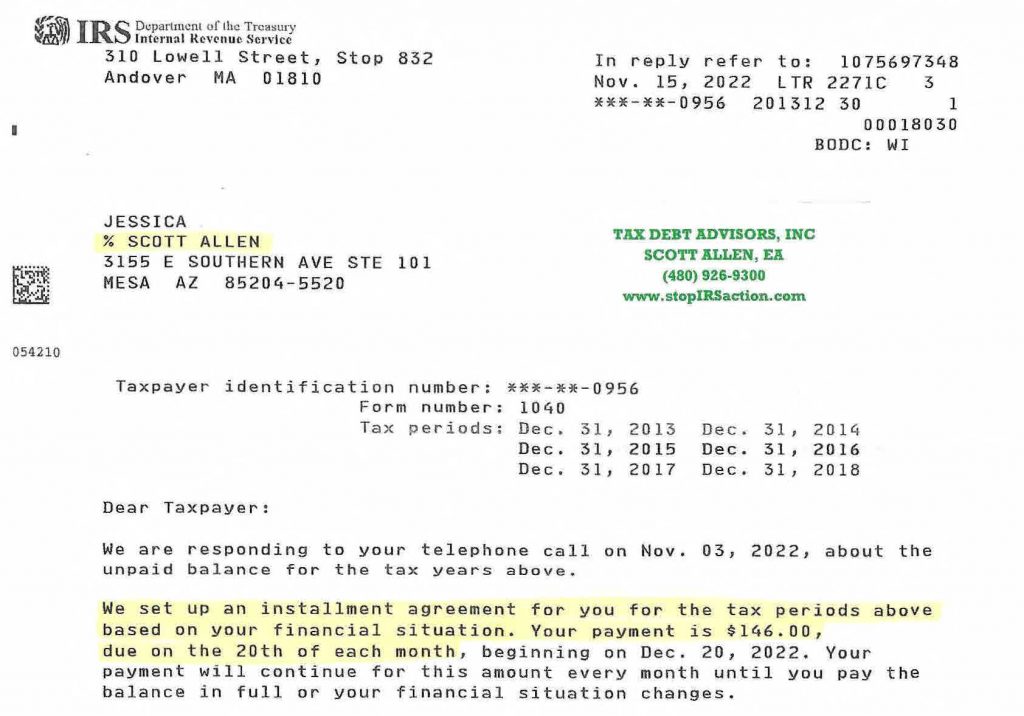

Scott Allen EA with Tax Debt Advisors, Inc specializes in settling and filing back tax returns in Phoenix. Jessica was a struggling Phoenix taxpayer who hired scott to help her with her back tax returns. Being behind on six years worth of taxes, she felt like she was drowning. On top of that, the IRS was threatening to garnish her wages in the form of a levy. What Jessica needed was an aggressive Enrolled Agent to represent her before the IRS and settle her Phoenix back tax returns into one low monthly payment she could afford. That is exactly what was done. If you view the IRS acceptance letter you will see the IRS agreed to put all her IRS debt into a $146 per month payment plan. Congratulations Jessica!

What does the IRS ask for from a taxpayer trying to negotiate a payment plan?

- Total household monthly income

- Current taxes being paid

- Value of current retirement accounts

- Recent bank statements

- Rent or mortgage payment

- Utility bills

- Car payments

- Monthly vehicle costs (i.e. gas, insurance, registration)

- Health insurance premiums

- Out of pocket medical/dental expenses

- Student loan debt

- Term life insurance

- State taxes owed

- Child care expenses

This isn’t a complete list but generally is what the IRS will typically look at to determine your ability to pay off back tax returns in Phoenix over time. The IRS has a statute of limitations of ten years to collect a debt so they will do what they legally can to get as much paid off within that time period.