Call Scott Allen E.A. if you get an IRS Final Notice of Intent to Levy in Mesa AZ

IRS Final Notice of Intent to Levy in Mesa AZ

If you get a Mesa AZ IRS final Notice of Intent to Levy, the IRS means business and will begin to pursue your bank accounts and if you are an employee, your wages. By filing IRS Form 12153, a taxpayer is entitled to a Collection Due Process Hearing (CDPH). This is the time to get professional help to make a correct decision on how to settle with the IRS. Dealing with an Appeals Officer is the best situation to get as good a settlement as the IRS will allow. Appeals Officers have much more latitude to compromise on grey areas. They have a mandate to make a settlement with taxpayers to keep the system from a “log jam” of cases.

Scott Allen E.A. has the expertise to help you select and negotiate the best option so you do not receive an IRS levy. Scott knows what the Appeals Officer is likely to accept or compromise on. Call Scott Allen E.A. at 480-926-9300 to schedule a free consultation. Scott will make your appointment a positive experience and make that day a great day for you!

Your Mesa Arizona IRS Tax Professional

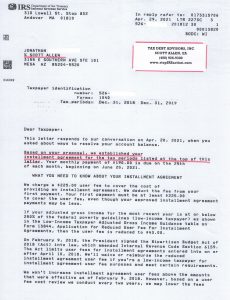

Avoid an IRS final notice of intent to levy in Mesa AZ and get a settlement negotiated on your back IRS taxes. Jonathan did just that. Once you have an agreed payment plan with the IRS they cannot take any enforcement action. You can view Jonathan’s agreement below.