Call Scott Allen E.A. of Phoenix AZ to lower your IRS Tax Liability

Scott Allen EA for your Phoenix AZ IRS Tax Liability

Here is a simple checklist to review to see if your IRS tax liability is correct:

- Get an IRS record of account and verify that all of your payments have been credited to your account. The IRS does on occasion misapply payments. Also sometimes your check did not clear the bank and you were unaware.

- Always designate where you want payments to be applied if you do not want the payment applied to the oldest tax year that has a balance due. If the IRS has applied your payment to the incorrect tax year, you can call them and get it corrected.

- The best way to lower your IRS tax liability is to make sure each tax debt is from a filed return. If the IRS has filed a tax return it is called a substitute for return and Scott can file a correct return and in most cases get the tax debt reduced.

- The second best way to lower your IRS tax liability is to have Scott Allen E.A. near Phoenix AZ review your current return and see if it needs to be amended for deductions that were overlooked.

- The third best way to lower your tax liability is to see if penalty abetment is warranted. Scott has expertise in filing IRS form 843 if you have a legitimate reason to get your IRS penalties reduced.

Scott Allen E.A. provides a free consultation for Phoenix AZ neighbors to evaluate whether you can lower your IRS tax liability. Call Scott at 480-926-9300 for an appointment.

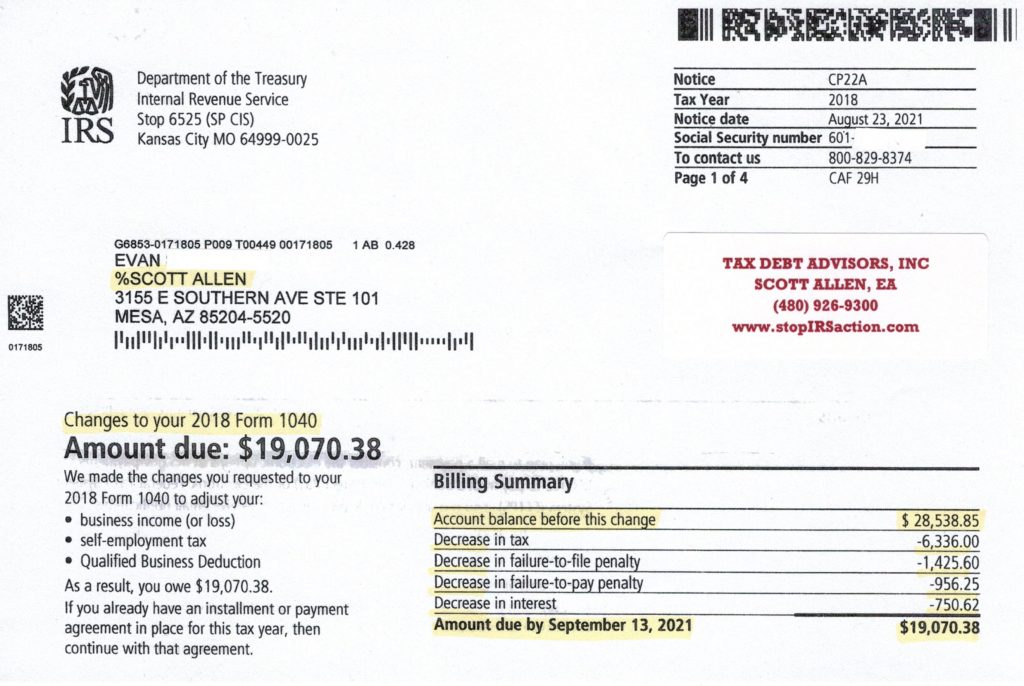

View the letter below from the IRS showing what Scott did for his client Evan. He was able to lower his Phoenix AZ IRS tax liability by $9,000 on his 2018 taxes. If you are uncertain about the way your tax returns were prepared you have three years to amend them.

0