Call Tax Debt Advisors, Inc. for Phoenix AZ IRS Wage Garnishment Help

Phoenix AZ IRS Wage Garnishment

The IRS knows you are serious about getting your tax liability settled when they are contacted by your representative. The same is true if your wages are being garnished by the state you live in. Scott Allen E.A. of Tax Debt Advisors, Inc. has the expertise to quickly advise you on what you need to provide to get your Phoenix AZ IRS wage garnishment released. Tax Debt Advisors, Inc. offers a free initial consultation and can be reached at 480-926-9300. We have been representing taxpayers with wage garnishments for over 40 years.

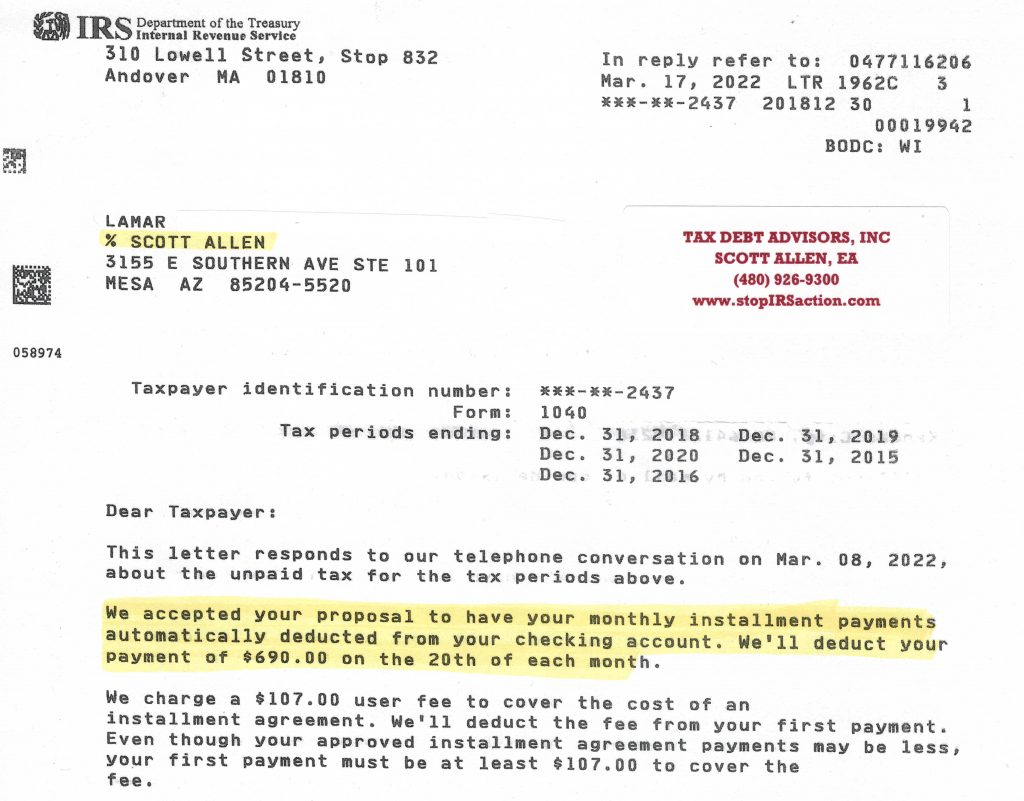

Scott Allen EA was able to help Lamar with his Phoenix AZ IRS wage garnishment by negotiating his five years of IRS debt into one monthly installment arrangement. With household income of over $210,000 it can be difficult to work out a reasonable arrangement but at $690/month it made it very doable for them to pay the IRS and also keep up with their household bills as well. View the IRS approval notice below.

A payment plan is just one of several way to stop an IRS wage garnishment. To find out more contact Scott Allen EA and schedule a consultation appointment.