Tax Debt Advisors—IRS Levy Facts for Gilbert Arizona residents

Avoid Gilbert Arizona IRS Levy with Representation

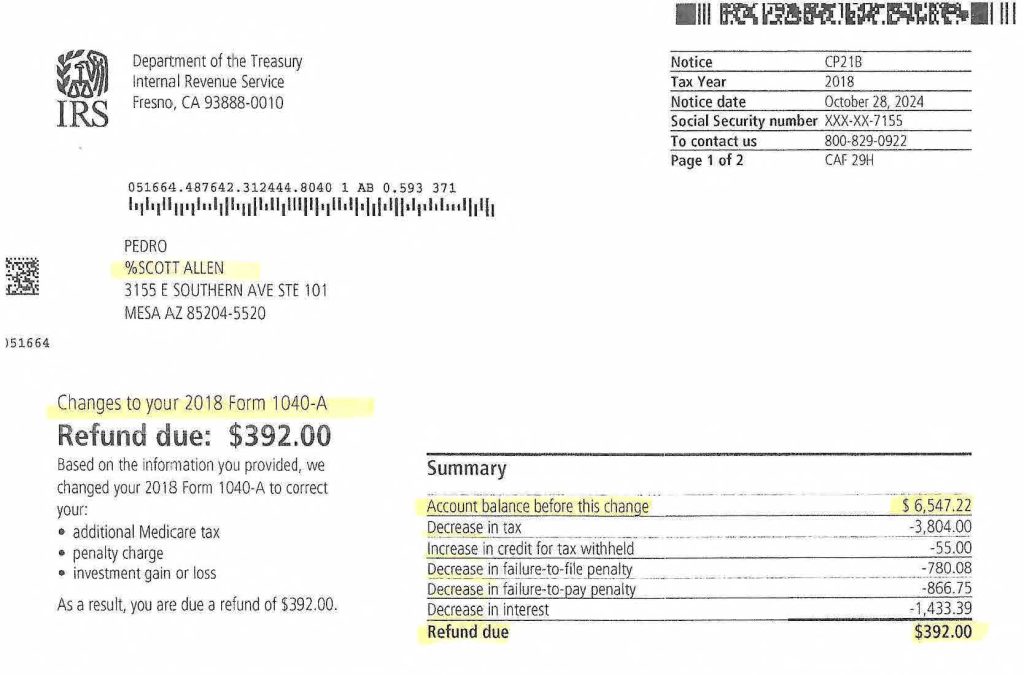

Pedro was represented by Scott Allen EA of Tax Debt Advisors and avoided an IRS Levy in Gilbert Arizona by protesting an IRS SFR tax return and eliminating the entire tax bill due. See the notice below. This is just one of many ways Scott can represent you before the IRS as power of attorney.

Actions the IRS can take if you continue to avoid the situation

- IRS is legally entitled to take and keep any money levied from a bank account if you owe IRS taxes up to the amount of taxes owed.

- IRS is legally entitled to levy up to 80% of you salary until all of your tax liability is paid off.

- IRS is legally entitled to levy up to 15% of your social security retirement monthly income.

- IRS is legally entitled to lien all your assets until you pay off your IRS tax debt.

UNLESS…

You have IRS help from someone with expertise in IRS matters; not just a part of their business but the entire focus of their business. Tax Debt Advisors has resolved over 114,000 IRS tax debts since 1977, that’s over 46 years. Scott Allen E.A. has helped hundreds of clients at dozens of companies get their levies released. Some of the companies include:

- Banner Thunderbird Medical Center

- Arrowhead Hospital

- Midwestern University

- Sanderson Ford

- Cabela’s

Don’t face the IRS alone and wish you had gotten professional advice after the fact. Call Tax Debt Advisors near Gilbert AZ at 480-926-9300 for a free initial consultation. You will be glad you did!