Chandler AZ IRS Bank Levy Release now!

Fidel’s Chandler AZ IRS Bank Levy Release

If you have ignored prior IRS notices or not received them because they were sent to a previous address, the IRS will eventually levy your bank account in Chandler Arizona. The IRS notice informing you that they have levied your bank account has a 21 day time limit to rectify your situation. Once that time deadline is passed your bank is under obligation to send whatever funds you have in your bank account up to the amount owed to the IRS. The IRS does not care what consequences you face because of the bank levy. If you have the ability to pay of the IRS tax debt and know that you owe the amount due, it is best to pay off the IRS tax liability and get the bank levy released. If you do not owe the money or less than the bank levy amount, it is best to contact Scott Allen E.A. at Tax Debt Advisors, Inc. to get professional advice. Even if you owe the amount of the bank levy, you may qualify for one of several IRS settlement options that will reduce or eliminate your IRS tax liability. Contact us today at 480-926-9300 and schedule your free initial consultation. Tax Debt Advisors, Inc. has been releasing bank levies since 1977.

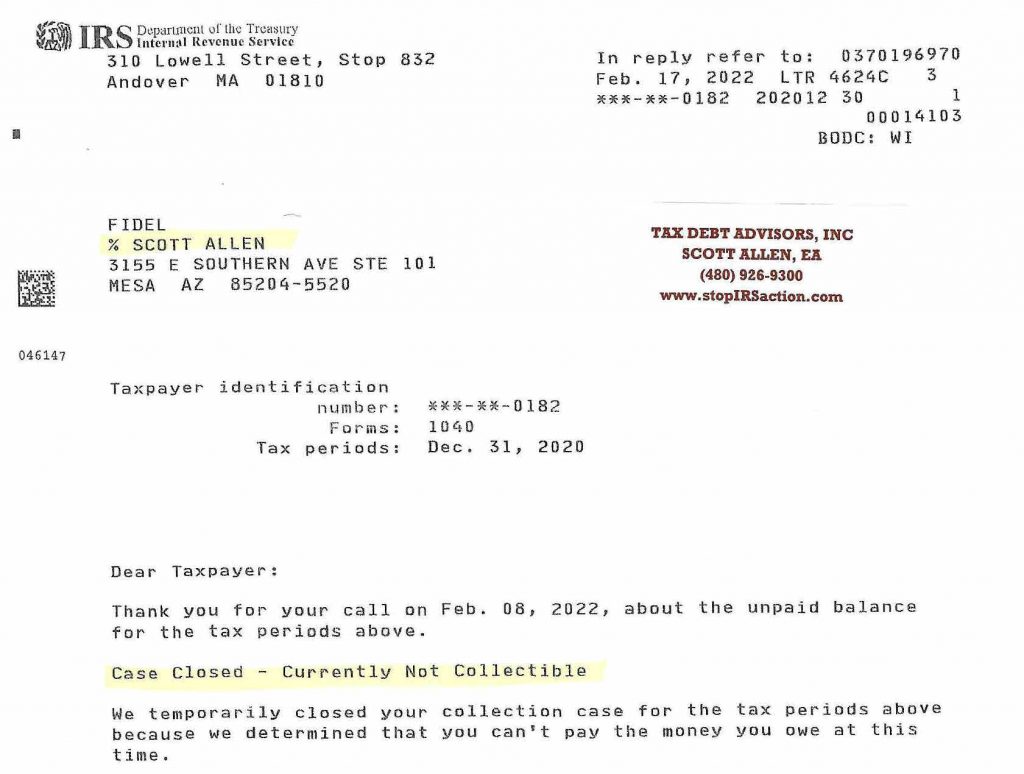

Scott Allen EA was able to get a Chandler AZ IRS Bank Levy Release for Fidel. Fidel was living paycheck to paycheck and needed some bigtime relief after the IRS levied his bank account. Scott was able to represent him as his Power of Attorney and and negotiate his back tax debt into a currently non collectible status. See the settlement agreement below. If you are in IRS trouble and could use some proper representation do what Fidel did and meet with Scott this week.

1