Chandler AZ IRS tax attorney or not?

Michael and his wife settled with the IRS without the need for a Chandler AZ IRS tax attorney

The first questions Michael asked Scott Allen EA when he called was “Are you an attorney?”. Scott Allen EA’s reply, “No, I am not however 99% of IRS problems do not require a Chandler AZ IRS tax attorney”. Tax Debt Advisors has been successfully filing back tax returns and settling IRS debts since 1977. Over 108,000 IRS debt have been settled by them in that same time frame. Put their experience to work for you. Below is a recent example of what Scott Allen EA did for his client Michel and what he can also do for you.

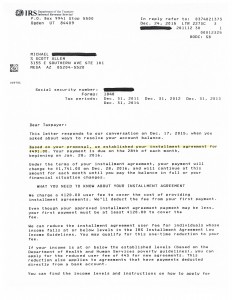

Michael came in to meet with Scott Allen EA to discuss his back tax returns and IRS levy notices he received. Upon meeting, it was determined that Michael was part of the 99% and Scott Allen EA could accurately work the case. They worked out a detailed plan on how to address the IRS levy notices and to get caught up on the unfiled tax returns. With proper representation a hold was secured on the account from all levy and garnishment action. This allowed time to organize, prepare and file the unfiled tax returns. This is what was done over the next couple weeks. With Michael and his wife now in full compliance with the Internal Revenue Service a settlement can be put in place. After a full review of their financial picture currently, we knew a payment plan would be the best option. We also knew $491 a month was the lowest the law would allow. As you can see from the IRS notice that it was Scott Allen EA was able to get negotiated.

Find out what is required to get you in full compliance with the IRS and to get the best settlement allowable by law in place. Scott Allen EA can represent you from beginning to end in matters of collections and tax preparations. Speak with him today for a free consultation.

Tax Debt Advisors Inc case settled: 2019

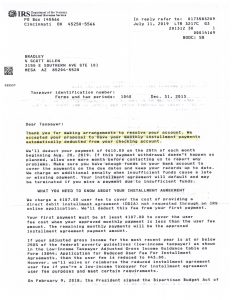

Bradley and his wife met with Scott Allen EA recently needing help with their IRS debt. They were looking for the right and honest solution to their problem. There is a lot of advertising out there on the internet, TV, and radio making misleading statements about dealing with the IRS (“Buyer Beware”). Just like Bradley did, you are invited to meet with Scott Allen EA for a free initial consultation to discuss your IRS matter. If you have an IRS debt that you cannot pay in full or behind on your tax preparation set up an appointment with Scott today. He will work to get you the best possible agreement with the IRS allowable by law.

Check out the notice below and see the settlement negotiated for Bradley.

If you are in fear of having your wages or bank account garnished, get Scott Allen EA as your IRS power of attorney and put a hold on all collection activity. Let’s beat the IRS together!