Do I Need a Glendale IRS Tax Attorney to do a Hardship Offer in Compromise?

Glendale IRS Tax Attorney?

No, this is not a legal matter and you don’t need to hire the first Glendale IRS Tax Attorney you talk to. However, it will take an IRS resolution specialist who has expertise in applying and getting approval from the IRS to accept your hardship case. Hardship means that it would cause you to suffer a severe hardship even though you can pay the tax liability. There must be unusual circumstances before one can expect the IRS to consider the taxpayer a hardship candidate. For this reason, hardship offers are rare compared to offers based on the ability to pay the full amount of the tax debt.

Some of the valid hardship situations would include:

- All of the taxpayer’s assets would be required to provide adequate medical care for an illness or physical disability.

- Payment of the tax debt owed would leave the taxpayer without means to cover necessary living expenses including housing, food, medical care, clothing and utilities.

- The taxpayer does not have the ability to liquidate or borrow against assets to pay the tax debt.

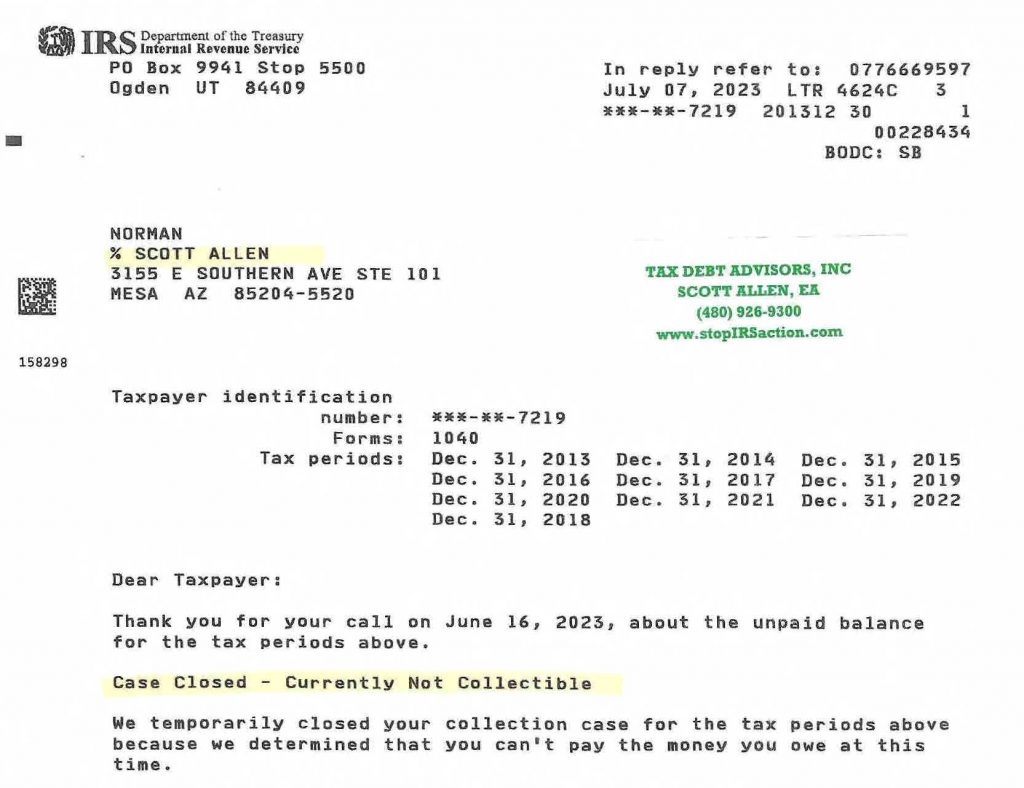

Sometimes seeking a currently non-collectible status (CNC can provide the same protection needed by the taxpayer. A CNC status is much easier to get approved by the IRS and is not difficult, in many situations, to be maintained until the statute of limitations for the collection of the taxes owed to the IRS has passed.

May I suggest you contact Scott Allen E.A. who has expertise in these matters and can navigate you towards the best settlement option at the lowest cost to you? Scott is available for a free consultation at 480-926-9300. Put your mind at ease and contact Scott Allen E.A. today instead of a Glendale IRS Tax Attorney. Below is an example of Scott Allen EA representing his Client Norman and negotiating all ten years of back taxes owed into a currently non collectible status. Always explore all options avaiable to you before submitting an IRS offer in compromise or any other tax settlement solution.