Enrolled Agent vs Scottsdale AZ IRS Tax Attorney

Do I need to hire a Scottsdale AZ IRS Tax Attorney over an Enrolled Agent?

First, it is important to understand what an Enrolled Agent is so you can compare Scott Allen to a Scottsdale AZ IRS Tax Attorney. As an Enrolled Agent, Scott Allen is licensed federally to practice before the Internal Revenue Service in all 50 states. Practicing before the IRS means one is able to prepare tax returns and speak in their behalf in matters of collections and audits. The IRS form 2848 gives Scott Allen EA Power of Attorney authorization.

Click here to read more about Enrolled Agents.

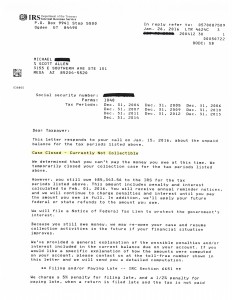

Recently, Scott Allen EA was able to negotiate ten years of back taxes for his client Mike. Mike is a self employed individual who through a struggling economy here in Arizona was barely making enough money to cover his living expenses let alone pay his taxes. Upon meeting with Scott Allen EA for a free initial consultation they were able to start a working relationship together.

Mike gave him Power of Attorney authorization and went to work. IRS levy action was prevented and over the course of the next month all back tax returns were filed and submitted to the IRS timely. Once all the tax returns were accepted by the IRS Scott began the negotiation process. Basic financial information was gathered up and evaluated. It was determined that Mike’s best settlement option was to negotiate and non collectible status to cover all his back tax debts. Below you can view for yourself the actual IRS settlement acceptance.

Non collectible status is only one of several different options a taxpayer has to resolve an IRS debt. Not everyone qualifies for this status but for those that do it puts them in an excellent situation. If you are not a candidate for a non collectible status you will be advised on the next best option. Every option has pros and cons and it is important to review those before a settlement negotiation is started. If you are not being advised on all the options you are not being represented fully.

Start off on the right foot today by calling and speaking with Scott Allen EA. If you are in search of a Scottsdale AZ IRS tax attorney you are encouraged to compare him to Scott Allen EA first. Even if you decide not to hire him you will benefit by spending 30 minutes with him.

November 2018 Case Update

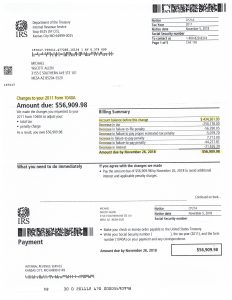

It is possible to NOT have to hire a Scottsdale AZ IRS tax attorney and save $378,000. How can that be? Check out the approval IRS notice below to see what Scott Allen EA did for his client Michael. The IRS had filed a 2011 individual income tax return for the taxpayer. In doing that, Michael owed the IRS over $430,000 in taxes, interest and penalties. With hiring Scott Allen EA as his Power of Attorney he challenged their return with a corrected taxpayers return. After three long months, it was approved!

If you feel the IRS has put you in a similar situation make that phone call to speak with Scott Allen EA. He will personally take your call and evaluate you case.