File back tax returns in Gilbert AZ with Tax Debt Advisors Inc

We are Arizona’s Premier IRS Tax Problem Advisors.

One of the main components to getting an IRS settlement completed with the IRS is that all of your required Gilbert AZ back taxes returns must be filed. The word “required” is used for a very specific reason. With the IRS you never want to make assumptions on what needs to be done. Their number one main goal is to collect a debt. Their second goal is to also collect a debt. Always remember that. They may not always have your best interest in mind. Before ever beginning to file back tax returns in Gilbert AZ an IRS power of attorney authorization will be signed so Scott Allen EA can contact the them directly to “XRAY” your account with the IRS. With this he can find out all the back tax return issues: what years need to be filed and what years the IRS may not be looking to be filed anymore. Scott Allen EA has saved his clients thousands of dollars just by taking this simple but important step. Sometimes the IRS will file back tax returns for you called Substitute For Return. If this has been done information needs to gather from the IRS on how to protest their filing. The IRS usually files Gilbert Arizona back tax returns in a way that is negative to you. Protesting their filing will usually benefit you greatly by lowering what you owe them in back taxes.

Tax Debt Advisors specializes in filing back tax returns. If you need this service they will be able to represent you through the entire process. Once your back taxes are all filed then negotiations can begin. Tax Debt Advisors will advise you on all available options to settle your IRS debt.

Some of the available options to settle your debt are:

- IRS currently non collectible

- IRS installment arrangement

- IRS offer in compromise

- Tax motivated bankruptcy

- Penalty Abatement

Talk with Scott Allen EA today to discuss your options. He can secure a hold on all collection activity today so you have adequate time to make the right decision. Don’t be a victim of an IRS wage garnishment or bank levy.

September 2018 update on a new case:

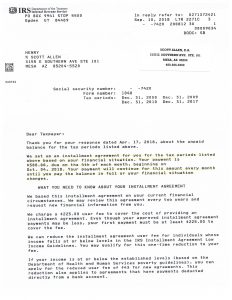

If you are reading this blog you might have unfiled tax returns in Gilbert AZ. Don’t let that scare you. Many taxpayers have found them in the same situation and have gotten out of it. Henry was one of those. He had a couple years to get caught up on and negotiate an agreement on. Tax Debt Advisors filed the missing tax returns and set up an installment arrangement of $500/month to settle his IRS debt that is over $200,000. That is not a type… yes $200,000 IRS debt.

Scott Allen EA of Tax Debt Advisors has been handling tax preparation and IRS negotiation work since 2007. Before that the business was owned and operated by his father for over 30 years. Meet with Scott today for an analysis of your tax situation. He will make today a great day for you.