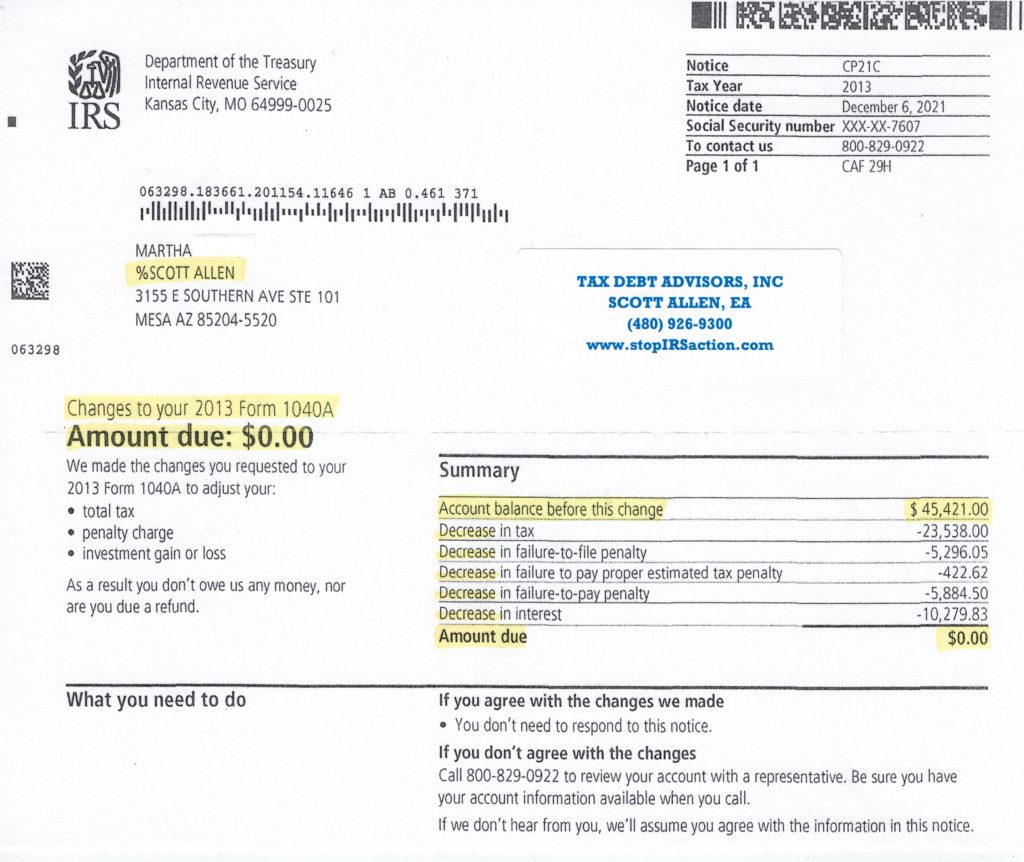

File Back Taxes Phoenix and save $45,421.00

File Back Taxes Phoenix

Martha called Tax Debt Advisors, Inc in a panic because not only did she have to file back taxes Phoenix but the IRS had made a substitute assessment on her 2013 tax year. This substitute assessment by the IRS claimed she owed them $45,421.00. Wow, what a shock this was to Martha. Not only did she not file 2013 but nothing for 2014 thru 2020 either.

Tax Debt Advisors, Inc was able to walk Martha thru the steps to resolve her IRS matter and save her paychecks and bank accounts from IRS levy. By signing Tax Debt Advisors, Inc over as her Power of Attorney they were able to investigate what records the IRS had on her for all her delinquent years (especially 2013) where they came up with a massive tax amount owed. Tax Debt Advisors, Inc discovered that when the IRS filed the substitute filing they accounted for all of her stock sales but none of her stock basis. Once we determined her basis, a proper accurate tax return was filed resulting in ZERO taxes owed. Yes, ZERO! Click on the IRS notice below to see for yourself. Not only did she have enough stock basis to owe no taxes, but she had capital losses to carryforward to her 2014 tax return to help lower her taxable income on that return as well.

When you have to file back taxes Phoenix it is extremely important that you have proper IRS representation. Scott Allen EA with Tax Debt Advisors, Inc is that choice if you live in or near Phoenix Arizona. Don’t delay and schedule that initial phone or office consultation today.