How to file Back Tax Returns Gilbert AZ?

The Why, When How, What and Who should help you File Back Tax Returns in Gilbert AZ

- Why file back tax returns Gilbert AZ?—every day that you delay filing back tax returns you are accruing interest and penalties. If you have a refund and the return is older than three years the refund is lost and cannot be apply against years you owe.

- When is the best time to file back tax returns Gilbert AZ?—as soon as possible. There is no reason to delay filing. In fact it is best to send them in as they are completed rather than wait until you have them all done. When back tax returns are filed, they should be mailed separately in their own envelope.

- How to file back tax returns Gilbert AZ?—always use the forms for the year that is being filed. Changing the date on the current 1040 forms will not be accepted by the IRS. Find an IRS professional that has all the original forms for each year that needs to be filed.

- What should be filed with your back tax returns Gilbert AZ?—Along with the 1040 forms you must include all supporting schedules. Make sure you have adequate support for deductions claimed. There is a greater chance that when you file back tax returns that you could be audited.

- Who should I use to help me file back tax returns Gilbert AZ correctly?—Scott Allen E.A. of Tax Debt Advisors, Inc. has the experience and expertise to help you file your back tax returns and get you the best settlement allowed by law. Scott offers a free initial consultation and you can schedule with him personally by calling 480-926-9300. Tax Debt Advisors near Gilbert AZ has settled over 110,000 tax debts for clients since 1977. Scott Allen E.A will make your first appointment with him a great day!

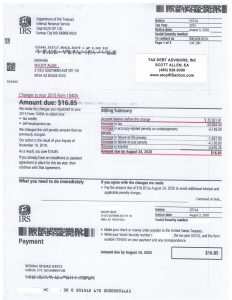

Recently Scott Allen EA filed back tax returns for a client. One of those years being 2015. This was a year that the IRS audited and selected to file a return for the taxpayer because he had not. Based upon their numbers the taxpayer owed over $35,000. When a protested tax return was filed the taxpayer only owed the IRS $16. To reiterate, always use an experienced tax professional to represent you in back tax return filings. It can be a $35,000 decision.

0