IRS debt now gone thru Gilbert AZ back tax returns filed

Bill is on “Cloud 9” right now after filing his Gilbert AZ back tax returns.

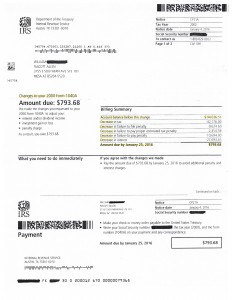

Bill had come in to meet with Scott Allen EA with his wages being garnished for the second month in a row not knowing how to correct the situation. The IRS claimed he owed over $90,000 in back taxes just on his 2000 federal tax return; a debt nearly 15 years delinquent. To see the result accomplished by Scott Allen EA in his behalf view the IRS notice below.

Through a systematic process Scott Allen EA challenged the IRS decision on the taxpayers 2000 tax return. Bill never got around to filing his tax return for that year. He was single, out of work for a while, and it was the last thing on his mind. That year he did a lot of buying and selling of stocks through a brokerage account. Among all the buying and selling he had a net profit on that of about $14,000. However, the IRS only knew about the gross amounts (every sell transaction was reported to the IRS) and the cost basis information was unknown to them. So, when the IRS filed the tax return for him they did so on the gross amounts resulting in an outrageous tax debt.

Scott Allen EA was able to represent Bill by getting an IRS power of attorney and investigating all the issues and how to get everything resolved on the account. He put an immediate stop to the IRS wage garnishment while getting the tax return prepared and submitted to the IRS. This was a huge relief to him and his young family especially since the holiday season was approaching.

If you have Gilbert AZ back tax returns to be filed, be sure to work with someone experienced in the matter. Dealing with back tax returns is different then dealing with current year filings. Just like there are a number of different kind of doctors who specialize in different forms of medicine there are different accountants who deal with different areas of tax.