Local Professional Help in Filing Back Tax Returns in Gilbert AZ

Filing Back Tax Returns in Gilbert, AZ: A Professional Guide to Hiring Scott Allen EA

In the picturesque town of Gilbert, Arizona, residents often find themselves juggling their financial responsibilities. As tax season approaches, many individuals and businesses may realize that they have unfiled back tax returns, which can be a stressful situation to handle on their own. That’s where Scott Allen EA, a trusted Enrolled Agent, comes to the rescue. In this comprehensive blog, we will explore the process of filing back tax returns in Gilbert, AZ, and highlight the valuable services provided by Scott Allen EA.

Understanding Back Tax Returns

Before diving into the process of filing back tax returns in Gilbert AZ, it’s crucial to grasp the concept of back taxes. Back taxes are unpaid taxes from previous years, which may result from various reasons such as financial hardships, life events, or simple oversight. Filing back tax returns is essential, as it helps individuals and businesses come into compliance with tax laws and avoid potential penalties and legal actions.

The Importance of Filing Back Tax Returns

Failing to file back tax returns in Gilbert AZ can have severe consequences, including:

- Penalties: The IRS may impose penalties for each unfiled return, which can quickly accumulate into a substantial amount.

- Interest: Back taxes accrue interest over time, compounding the overall amount owed.

- Legal Consequences: In extreme cases, the IRS may pursue legal action, such as wage garnishment or asset seizure.

- Loss of Tax Refunds: Unfiled tax returns can result in the forfeiture of tax refunds.

- Borrowing Impact: Failure to address back taxes can negatively affect your credit report, making it difficult to secure loans or mortgages.

The Solution: Hiring Scott Allen EA

Scott Allen EA is a highly reputable Enrolled Agent who specializes in resolving tax-related issues in Gilbert, AZ. An Enrolled Agent is a federally-authorized tax practitioner empowered by the U.S. Department of the Treasury to represent taxpayers before the IRS.

Here are some reasons why hiring Scott Allen EA is the best solution for handling back tax returns in Gilbert AZ:

- Expertise: Scott Allen EA possesses a deep understanding of tax laws, ensuring that your back tax returns are prepared accurately and in compliance with IRS regulations.

- Negotiation Skills: As an Enrolled Agent, Scott Allen is equipped to represent clients before the IRS, which is invaluable when dealing with complex tax issues.

- Relief from Stress: Dealing with back tax returns can be overwhelming, but Scott Allen EA takes the burden off your shoulders, allowing you to focus on other important aspects of your life or business.

- Tailored Solutions: Scott Allen EA creates customized tax strategies to address your specific needs, ensuring the best possible outcome for your situation.

- Reduction of Penalties and Interest: Scott’s expertise can help you negotiate with the IRS to potentially reduce or eliminate penalties and interest on your back taxes.

- Protection of Assets: By enlisting Scott’s help, you can safeguard your assets from IRS collection actions.

The Process of Filing Back Tax Returns with Scott Allen EA

Here’s a step-by-step guide to how Scott Allen EA can assist you in filing your back tax returns:

1. Initial Consultation

The process begins with an initial consultation where you’ll meet with Scott Allen EA to discuss your situation. During this meeting, you’ll can provide all relevant financial documents and share your tax history. This information helps Scott assess the extent of your tax issues.

2. Analysis and Strategy Development

After a thorough examination of your financial situation, Scott Allen EA will develop a personalized strategy to address your back tax returns. This may include gathering missing financial records, organizing your financial history, and developing a plan to file back taxes. He will do this by being your Power of Attorney representitive before the IRS.

3. Back Tax Return Preparation

Scott Allen EA will meticulously prepare your back tax returns for submission. This process involves ensuring that all deductions, credits, and exemptions are applied accurately, maximizing your chances of a favorable outcome.

4. IRS Representation with Form 2848

Once your back tax returns are ready, Scott Allen EA will represent you before the IRS. This representation is invaluable in negotiating with the IRS, discussing payment plans, and working towards the best possible resolution for your situation.

5. Resolution and Follow-Up

Scott Allen EA will work diligently to achieve the best resolution for your back tax issues. Whether it involves setting up an installment agreement, an offer in compromise, or another IRS program, Scott will guide you through the process and follow up until your issues are resolved.

The Benefits of Choosing Scott Allen EA

- Experience and Expertise: Scott Allen EA has extensive experience in handling back tax issues and has a deep understanding of tax laws and regulations.

- Proven Track Record: Scott has a history of successfully helping individuals and businesses in Gilbert, AZ, resolve their back tax problems.

- Personalized Service: Scott takes a personalized approach to every case, ensuring that your specific needs are addressed effectively.

- Peace of Mind: Hiring Scott Allen EA provides you with the peace of mind that a qualified and experienced professional is handling your tax matters.

- Financial Relief: Scott’s expertise can often result in reduced tax liabilities and more manageable payment arrangements.

Filing back tax returns in Gilbert, AZ, can be a complex and daunting task. However, with the assistance of a skilled Enrolled Agent like Scott Allen EA, you can navigate the process with confidence and achieve the best possible outcome. Don’t let unfiled back taxes in Gilbert AZ continue to cause you stress and financial uncertainty. Reach out to Scott Allen EA today, and take the first step towards resolving your back tax issues and securing your financial future in Gilbert, AZ.

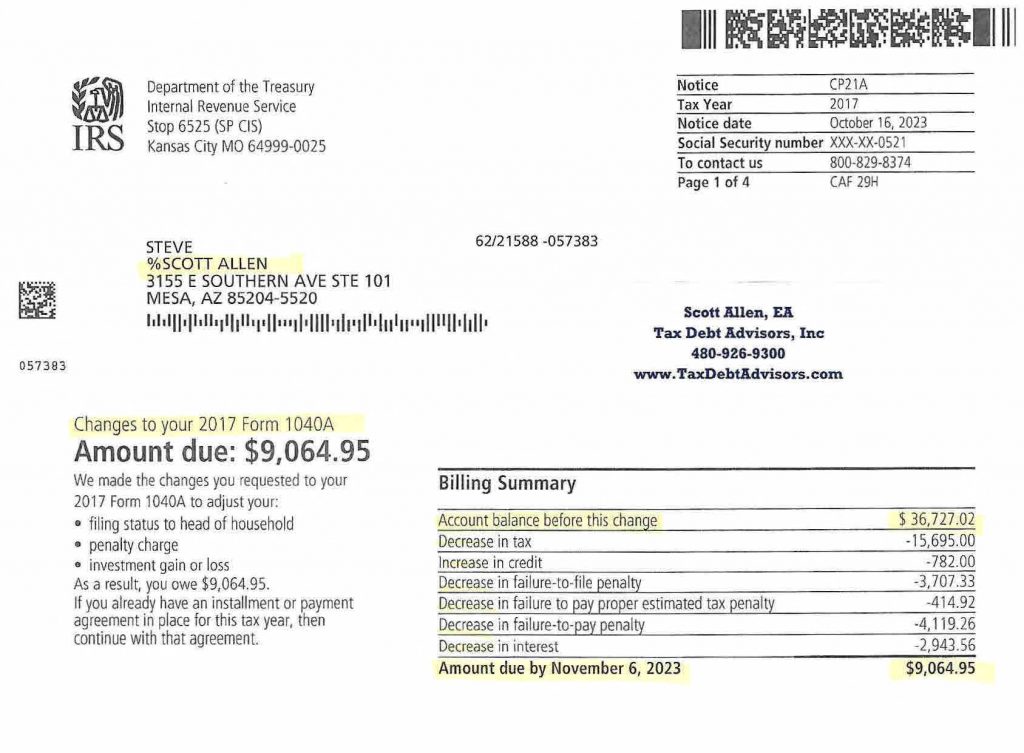

See how Scott Allen EA was able to help his client, Steve with filing back tax returns in Gilbert AZ. Over $27,000 was saved in back taxes owed by correctly filing his 2017 tax return. This is just one of thousands of successful cases Scott Allen EA has handled. Call Scott today and schedule a free no obligation consultation with him.