What option to settle IRS debt Mesa AZ ?

What option might you qualify for to settle IRS debt Mesa AZ

Far too often delinquent taxpayers have “tunnel vision” and only focus on one solution to settle IRS debt Mesa AZ. It will be very difficult to get a realistic resolution with this type of attitude. With Tax Debt Advisors, Inc you will be introduced to the many different available options right up front.

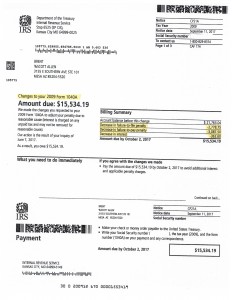

Brent came in to meet with Tax Debt Advisors, Inc wanting to settle his IRS debt in an Offer in Compromise. He see’s it advertised on the TV and radio daily and knew he must do that. However, during a consultation with Scott Allen EA he learned the real truths about an Offer in Compromise and found out at this time he isnt going to qualify. Brent needed to negotiate a payment plan. That is exactly what Tax Debt Advisors, Inc did for him. After that process was complete penalty abatement was applied for as well. Guess what? The IRS accepted penalty relief on his 2009 tax return. That is a tax return with a due date over seven years ago. This IRS penalty abatement request saved Brent over $6,200 in IRS debt.

As Scott Allen EA likes to explain to his clients, “you need to pick the right battles with the IRS”. This is a true statement. A proper representative will advise you upfront and honestly on all available options AND know what will and will not be successful before ever getting started. The average cost to hire a tax professional to negotiate an offer in compromise is about $3,500 and takes 12-18 months. Had Brent gone down that road blindly in “tunnel vision” he would have seen his Offer in Compromise denied, more interest and penalties accruing, 12 months of stress, and been out $3,500 in professional fees.

Don’t let that be the scenario for you. Find out the right option from the very first appointment with Tax Debt Advisors, Inc. Call today and schedule a free initial consultation.