Prevent IRS Levy Phoenix

Find out how to prevent IRS levy Phoenix

The last thing someone wants to see or hear is that their wages have been garnished by the IRS. Or equally as bad, the IRS has drained their bank account. Make today the day you prevent IRS levy Phoenix from happening. What are the steps to begin that process? I want to recommend Scott Allen EA of Tax Debt Advisors, Inc near Phoenix Arizona. He will clearly list the steps and process out for you. They are:

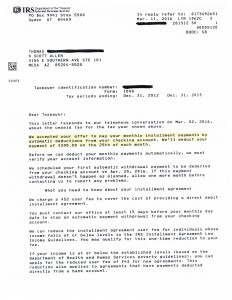

By going through those three necessary steps Tax Debt Advisors can prevent IRS levy Phoenix for you. Thomas was a taxpayer who contacted Scott Allen EA to get started with the three step process. Over the course of a few months Scott guided Tom through all the tax preparation phase and negotiating an aggressive agreement. Tom actually utilized two area in step three. Before working out a payment plan for him Tom filed a Chapter 7 bankruptcy to discharge about 75% of his tax debt (the years that qualified) along with some other non-tax debt. Yes, taxes can be discharged through bankruptcy! After the bankruptcy was completed they moved forward with an IRS settlement. Below is an image of the IRS agreement letter Scott Allen EA negotiated. This is just one of 1,000’s of examples of how Scott can also help you out as well.

Make the right decision today by meeting with Scott Allen EA of Tax Debt Advisors, Inc. He will help you from beginning to end.

December 2018 Case Resolution:

The best most obvious way to prevent IRS levy Phoenix is to negotiate a payment plan with them. In an agreement the IRS will not levy your bank account or garnish you wages. In many cases they will not file a notice of federal tax lien. Check out the recent settlement negotiated for Jacob, a current client of Tax Debt Advisors. With this agreement the IRS did not file a lien on Jacob.

Don’t put the IRS off any longer. Face it and you will be surprised the results will not be as bad as what your are expecting. Scott Allen EA is awaiting your phone call.