Resolving Back Tax Return Problems in Mesa, AZ

Resolving Back Tax Return Problems in Mesa, AZ: A Success Story with Scott Allen EA

Unfiled tax returns and back taxes owed can become a significant burden, leading to stress, financial strain, and potential legal consequences. For residents of Mesa, AZ, finding an effective solution to these tax issues is crucial. This blog will discuss how to resolve back tax return problems in Mesa, AZ, highlighting the success story of Richard, a client who used the services of Scott Allen EA at Tax Debt Advisors, Inc.

The Importance of Addressing Back Tax Returns

Unfiled tax returns can lead to severe penalties, interest, and even legal actions from the IRS. The longer the delay, the more significant the consequences. Addressing back tax returns promptly is essential to avoid these issues and regain financial stability.

Residents of Mesa, AZ, facing such problems should seek professional help to navigate the complex tax regulations and find the best resolution strategy. One such professional is Scott Allen EA, who has a proven track record of helping clients resolve their back tax return issues effectively.

Richard’s Journey: From Tax Chaos to Financial Relief

Richard, a resident of Mesa, AZ, had not filed his tax returns for seven years. Like many others, he found himself overwhelmed by the prospect of dealing with the IRS and unsure where to start. The mounting pressure and fear of potential repercussions made it challenging for him to take the first step.

Realizing the urgency of his situation, Richard decided to seek professional help. He reached out to Scott Allen EA at Tax Debt Advisors, Inc., a reputable family owned firm in Mesa, AZ, known for its expertise in resolving back tax return issues.

The Initial Consultation with Scott Allen EA

During his initial consultation, Richard shared his concerns and the extent of his unfiled tax returns. Scott Allen EA listened attentively, providing a safe and non-judgmental environment for Richard to explain his situation. Scott’s approach is always client-focused, ensuring that each individual’s unique circumstances are thoroughly understood.

Scott Allen EA conducted a comprehensive review of Richard’s tax history and financial situation. This initial assessment is crucial in determining the most effective strategy to address back tax returns and any outstanding IRS debt.

Developing a Customized Plan

Based on the detailed review, Scott Allen EA developed a customized plan tailored to Richard’s needs. The plan involved several key steps:

- Gathering Information: Scott assisted Richard in obtaining all necessary documents and information required to file the unfiled tax returns. This step is often daunting for clients, but Scott’s expertise made the process manageable and efficient through getting Power of Attorney authorizatrion.

- Filing Unfiled Tax Returns: Scott prepared and filed Richard’s tax returns for the past seven years. Accurate and timely filing is essential to prevent further penalties and interest from accruing.

- Negotiating with the IRS: With the tax returns filed, Scott Allen EA took on the task of negotiating with the IRS. His extensive experience and knowledge of IRS procedures were instrumental in reaching a favorable outcome.

- Setting Up a Payment Plan: Understanding Richard’s financial constraints, Scott negotiated a low monthly payment plan with the IRS. This plan allowed Richard to pay off his back taxes in manageable installments without compromising his financial stability.

The Outcome: A Fresh Start for Richard

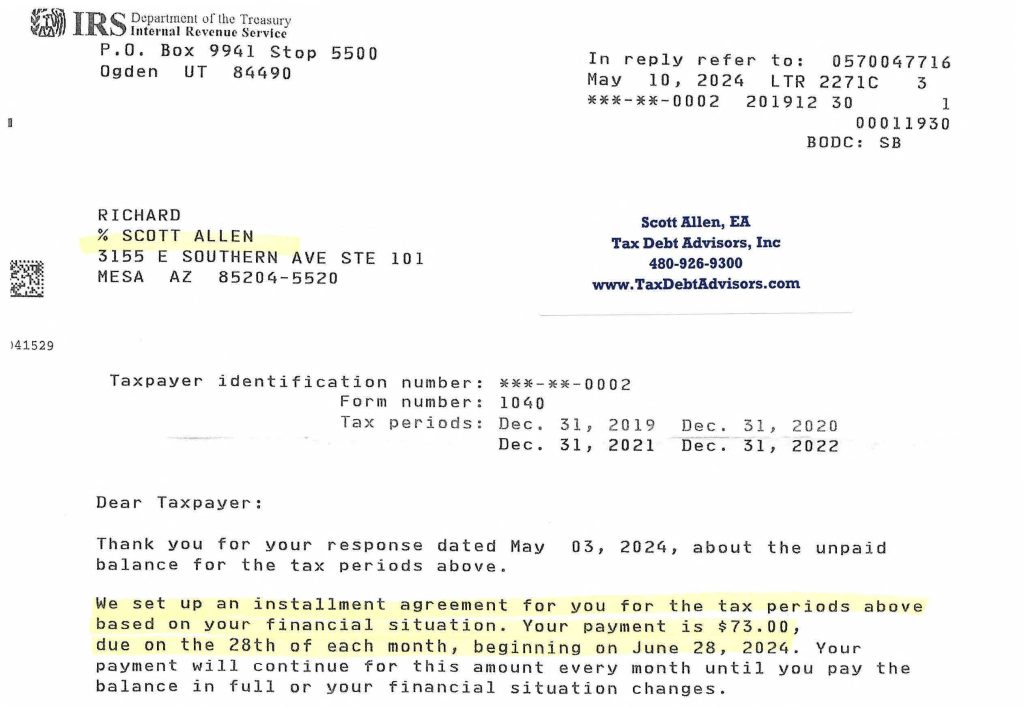

Thanks to Scott Allen EA’s expertise and dedication, Richard’s back tax return problems were resolved efficiently. Richard was placed on a very low $73 per month payment plan, making it feasible for him to manage his IRS debt without significant strain on his finances.

The relief was immediate. With his tax returns filed and a manageable payment plan in place, Richard could finally breathe easy. The constant fear of IRS actions was lifted, allowing him to focus on rebuilding his financial health and future. See the actual letter of settlement approval from the IRS below. Mission accomplished!

Why Choose Scott Allen EA?

Scott Allen EA and Tax Debt Advisors, Inc. have built a reputation in Mesa, AZ, for their exceptional service and success in resolving back tax return issues. Here are some reasons why residents of Mesa, AZ, should consider Scott Allen EA for their tax problems:

- Expertise in Tax Laws: Scott Allen EA has an in-depth understanding of tax laws and IRS procedures, ensuring that clients receive accurate and effective solutions.

- Client-Centered Approach: Scott’s approach is always client-focused. He takes the time to understand each client’s unique situation and develops customized plans to address their specific needs.

- Proven Track Record: With numerous success stories like Richard’s, Scott Allen EA has demonstrated his ability to resolve even the most complex tax issues.

- Negotiation Skills: Scott’s negotiation skills are a significant asset in dealing with the IRS. He works diligently to secure the best possible outcomes for his clients, whether through payment plans, offers in compromise, or other IRS programs.

- Comprehensive Services: From filing unfiled tax returns to negotiating with the IRS and setting up payment plans, Scott Allen EA offers a full range of services to help clients regain financial stability.

Steps to Resolve Back Tax Returns in Mesa, AZ

For residents of Mesa, AZ, facing back tax return issues, taking the first step can be the most challenging part. Here are some steps to help resolve back tax returns:

- Seek Professional Help: Contact a reputable tax professional like Scott Allen EA to discuss your situation. Professional guidance can make a significant difference in navigating the complexities of tax issues.

- Gather Necessary Documents: Work with your tax professional to gather all required documents and information. This step is crucial for accurately filing unfiled tax returns.

- File Unfiled Tax Returns: Ensure that all unfiled tax returns are prepared and filed promptly. This action stops further penalties and interest from accruing.

- Negotiate with the IRS: Allow your tax professional to negotiate with the IRS on your behalf. Their expertise can help secure favorable terms and manageable payment plans.

- Set Up a Payment Plan: If you owe back taxes, work with your tax professional to set up a payment plan that fits your financial situation. This plan will allow you to pay off your debt without compromising your financial stability. There are also other options to negotiate your IRS debt as well and Scott Allen EA will go over all of those options with you.

- Stay Compliant: After resolving your back tax issues, it’s essential to stay compliant with future tax obligations. Regularly file your tax returns and make timely payments to avoid future problems.

Resolving back tax return problems can be a daunting task, but with the right professional help, it is entirely possible. Richard’s story is a testament to the effectiveness of seeking expert assistance from professionals like Scott Allen EA at Tax Debt Advisors, Inc. in Mesa, AZ. By addressing his unfiled tax returns and negotiating a manageable payment plan, Richard was able to regain control of his finances and find peace of mind.

For residents of Mesa, AZ, facing similar issues, taking action today can lead to a brighter financial future. With the expertise of Scott Allen EA, resolving back tax returns Mesa AZ and managing IRS debt is not only possible but also achievable with minimal stress. Don’t let back tax return problems weigh you down—seek professional help and start your journey towards financial freedom.