Scott Allen E.A. can help save your Credit Score due to a Phoenix AZ IRS Tax Lien

Phoenix AZ IRS Tax Lien

Before the IRS files a Phoenix AZ IRS tax lien, you were given notice of your right to a Collection Due Process Hearing. The purpose of this hearing is to negotiate a settlement with the IRS that will prevent a tax lien from being filed. If this is ignored or not understood, the IRS will file a tax lien and your credit score could be damaged significantly.

Most clients contact us after a Phoenix AZ IRS tax lien has been filed and now want to have us help them get it removed and their credit rating restored. There are some options available to get the tax lien removed but the fact that the credit bureaus have already recorded a tax lien, your credit score will not be improved unless you personally contact them and provide them a lien release notice from the IRS—and if you are applying for a loan you will need to show the bank the Phoenix AZ IRS lien release notice. The fact that you still owe the IRS money and had a lien filed will still have a negative effect on your credit despite providing an IRS lien release notice.

Scott Allen E.A. has expertise in these matters and can help provide the information your loan officer may need to get that loan approved even if a Phoenix AZ IRS tax lien has been filed and later released. Call Scott Allen E.A. near Phoenix AZ today for a free consultation at 480-926-9300. Scott will make today a great day for you!

How Sean resolved his Phoenix AZ IRS Tax Lien

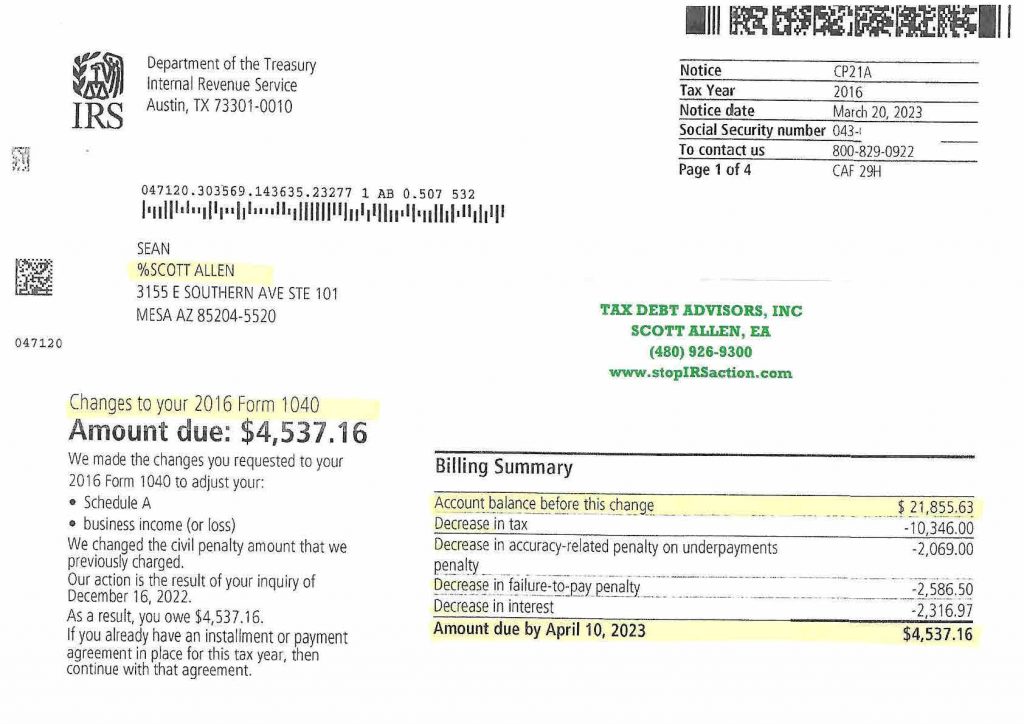

Sean was a Phoenix Arizona resident who was faced with a serious IRS tax lien. He had an outstanding IRS debt of over $21,000 for tax year 2016 for form 1040. He wanted the Phoenix AZ IRS tax lien resolved and put behind him. He met with Scott Allen EA of Tax Debt Advisors, Inc for a free consultation on the matter. After hiring him to be his IRS power of attorney representative he discovered that there were some errors with the tax return balance due. It didn’t accurately reflect all of his income, expenses and deductions. After this discovery, Scott Allen EA prepared and filed a protest return with the IRS to challenge their numbers. Upon doing so it was adjusted and saved Sean over $17,000 in taxes, interest, and penalties. Now that his IRS debt has been reduced to an accurate and manageable amount he can now get it paid off and get the IRS tax lien released. CHECK OUT THE IRS NOTICE BELOW AND SEE FOR YOURSELF!!! Don’t battle the IRS alone. Go with an Enrolled Agent who can be your IRS power of attorney.