Setup Scottsdale AZ IRS payment plan & no tax lien

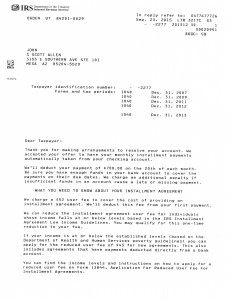

If you need a Scottsdale AZ IRS payment plan look no further then Tax Debt Advisors Inc. Below is an agreement that was setup by Tax Debt Advisors for a client who owes the IRS over $50,000 for a number of tax years.

When the client came in to meet with Scott Allen EA he stressed the importance of not having a tax lien filed with the IRS. Doing so would cause a hardship in his line of work and that could not happen. Scott Allen EA went over the IRS requirements to get a Scottsdale AZ IRS payment in place without a tax lien. With most agreement the IRS will still file a federal tax lien but there are ways around it for some clients. They were able to get this accomplished with this client on a $700 per month payment which is very doable on his income. As long as the client abides by the terms of the agreement the IRS will leave him alone. The most important part to the agreement is that the client has to file and pay his future tax returns on time.

If you would like to see if you could get your IRS debt into a Scottsdale AZ IRS payment plan call and speak with Scott Allen EA today to discuss your options with him. Sometimes a lien can be withdrawn or released from your credit on an already existing agreement. To see if you would qualify for that contact Scott Allen EA. Click here to view the IRS form 12277 to withdrawal the federal tax lien from your credit report.

Tax Debt Advisors Inc has helped thousands of taxpayers since 1977 get on IRS payment plans. Their family business will do just that; treat you like family.