Stop your IRS wage garnishment in Mesa AZ

IRS wage garnishments in Mesa AZ

Do you have options to stop your IRS wage garnishment if you live in Mesa Arizona?

Believe it or not, having the IRS garnish your wages (or bank account) is not the first thing on their mind to do. They would rather see you get into compliance with all of your tax return filings and work out a settlement with them. An IRS wage garnishment in Mesa AZ is usually after they have made several prior attempts to contact you through the mail or phone. However, often times they are trying to contact you with an outdated phone number or mailing address so you may not be aware of how close you may be to having your wages garnished by the IRS.

Don’t be a victim to a Mesa AZ IRS wage garnishment. I suggest you be proactive and you will get a much better end result. If you have already received your IRS wage garnishment notice lets meet for an initial consultation and evaluate your options. I do not charge for that visit. If you have not been garnished by the IRS in Mesa AZ yet, let us “beat them to the punch” and file your unfiled tax returns and work out a settlement with them prior to a wage garnishment threat. Call today and speak with Scott Allen EA. His company has a solid track record since 1977 dealing locally with IRS problem. It is important to note that every case with the IRS is unique based upon a persons individual income, expenses, debts and assets. Scott will evaluate all of these categories to determine your best case scenario with the IRS.

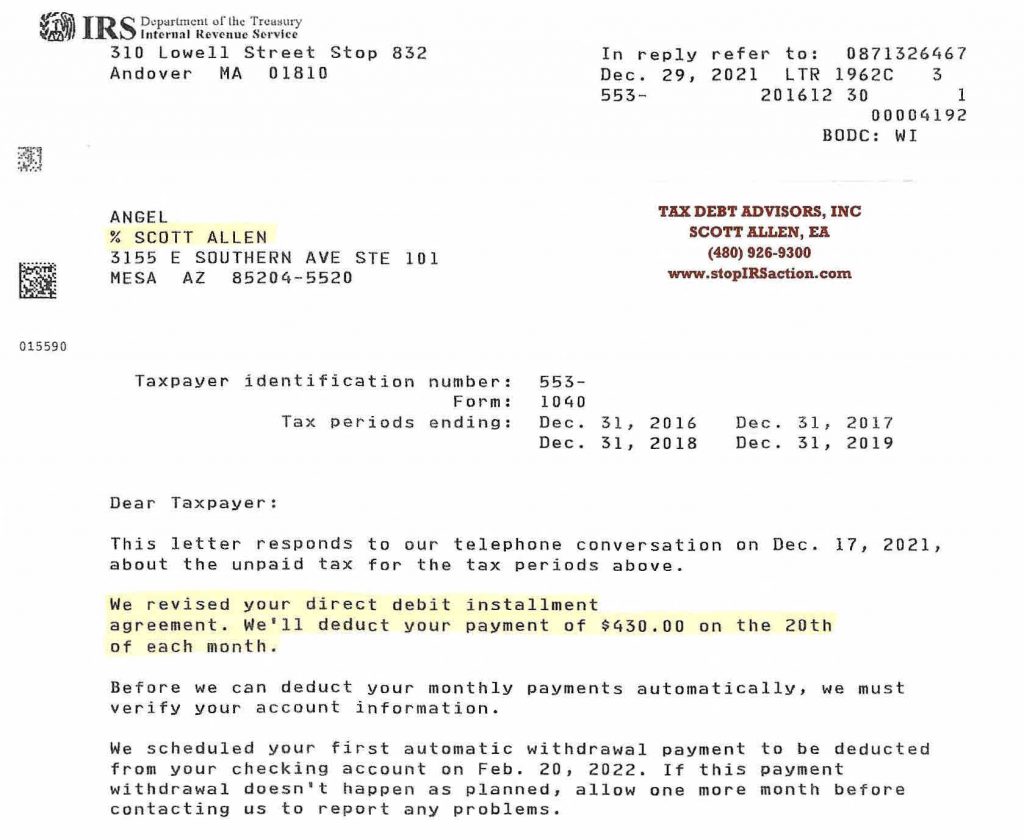

View the letter from the IRS below on a recent client Scott Allen EA help stop their IRS wage garnishment in Mesa AZ and negotiate it into a low monthly payment plan. Four tax years were put into a low direct debit installment arrangement of only $430/month.