Challenge Phoenix AZ back tax returns the IRS files for you

Did you know the IRS can file Phoenix AZ back tax returns in your behalf?

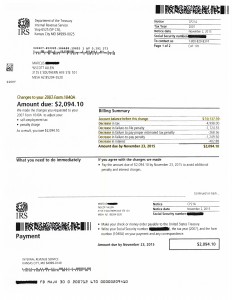

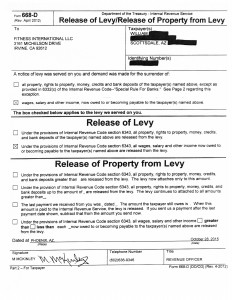

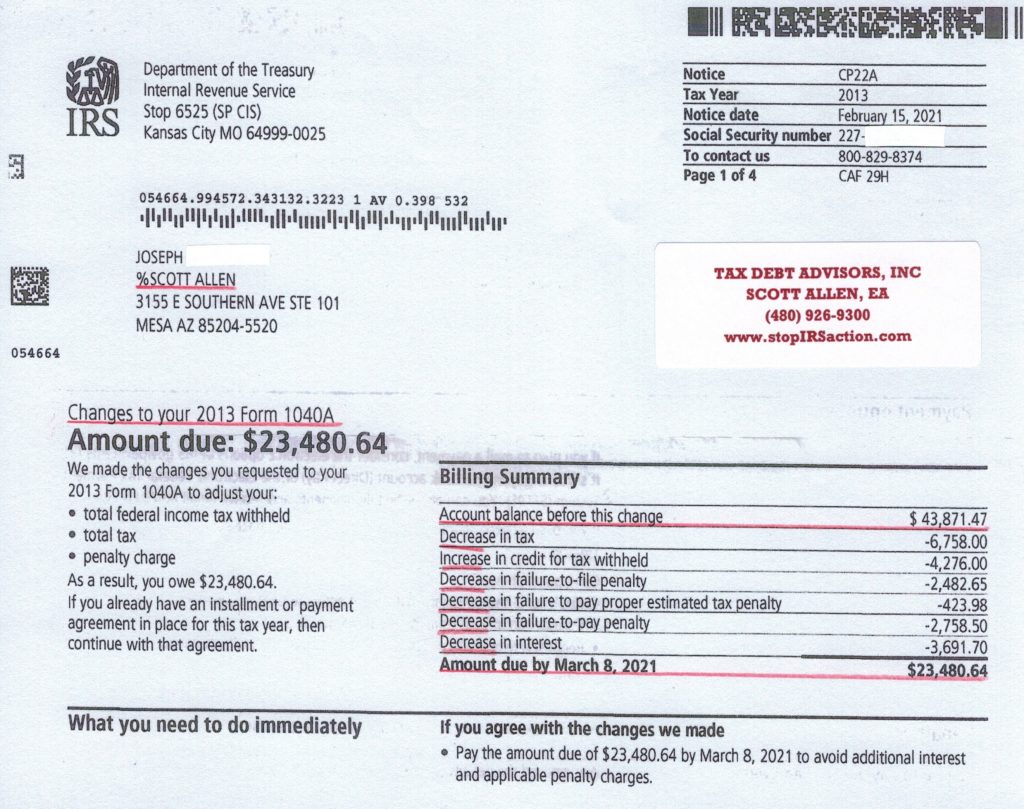

Guess what? It happens every single day. If you delay filing your taxes the IRS can elect to file those back tax returns for you. They refer to this as Substitute For Returns or SFR. This was the case for a client of Tax Debt Advisors. Marcus had not timely filed his 2007 1040 tax return. When the IRS did it for him they came up with a tax bill that accumulated to $10,137 in taxes, interest, and penalties. When Marcus came in to see Scott Allen EA he went over the process step by step in getting the issue resolved and how to “protest” their tax filing. It is not a matter of “if” the IRS will allow you to challenge their filings but rather “when”. The IRS does not look forward to doing this to taxpayers; they prefer they file the returns themselves. Below you will see the adjustment made on Marcus’s 2007 tax return that Tax Debt Advisors was able to protest. Now Marcus only owes the IRS $2,094 on his 2007 tax return.

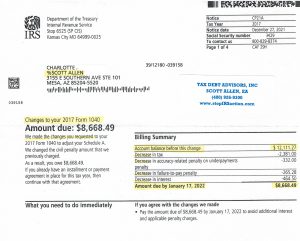

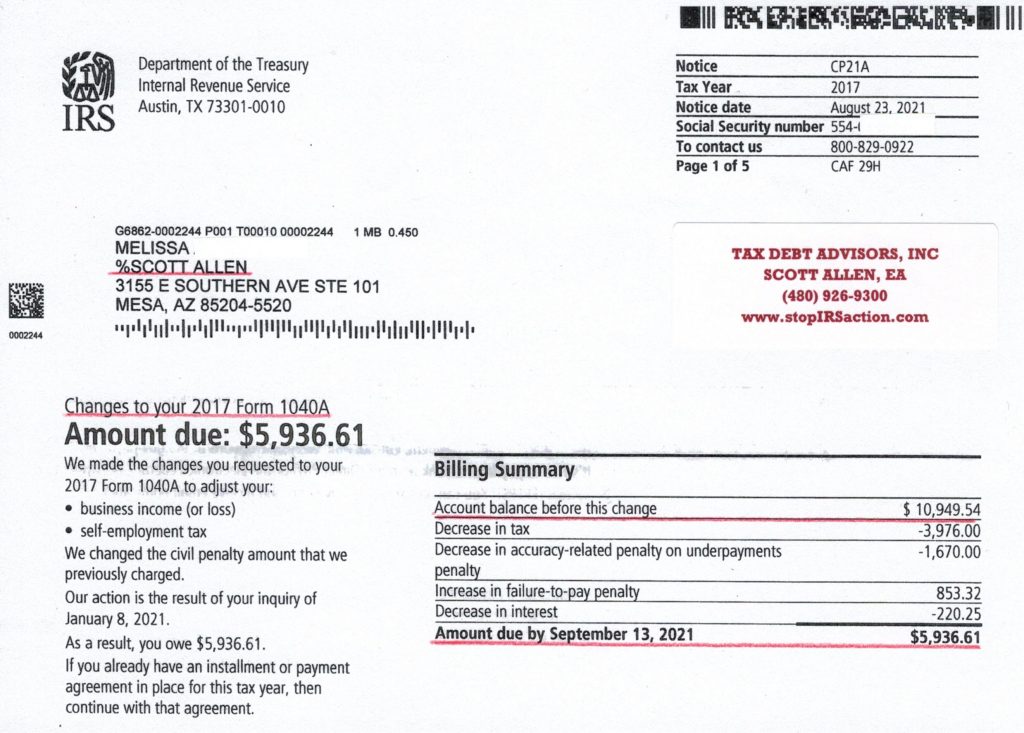

IRS filed Phoenix AZ Back Tax Returns for Charlotte too

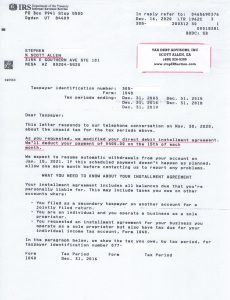

The Internal Revenue Service made an assessment against Charlotte on her Phoenix AZ back tax returns causing her to owe the IRS over $12,000. Scott Allen EA was able to evaluate the tax years and records and found a way they could protest the IRS assessment and reduce the amount she owes them. A proper Schedule A was amended on the tax return and reduced her tax bill by over $3,000. Click on the notice below on the successful resolution to Charlotte’s 2017 tax issue.

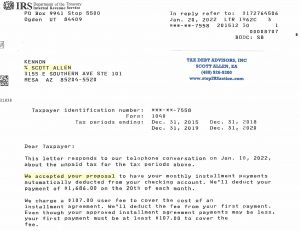

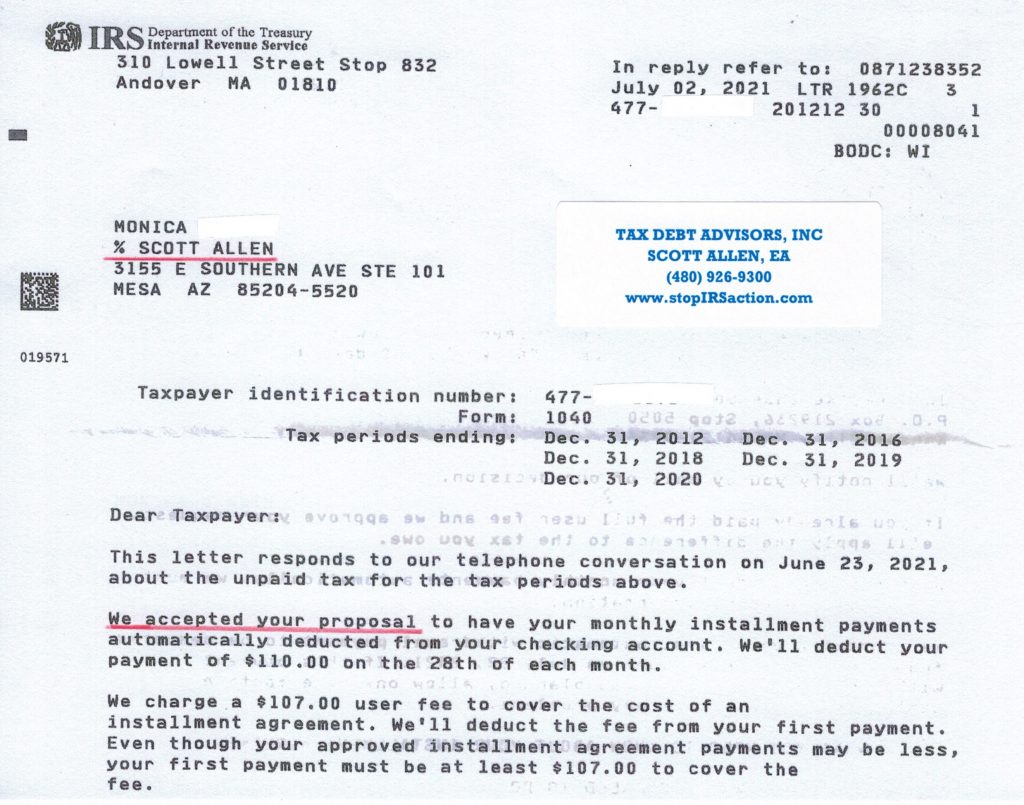

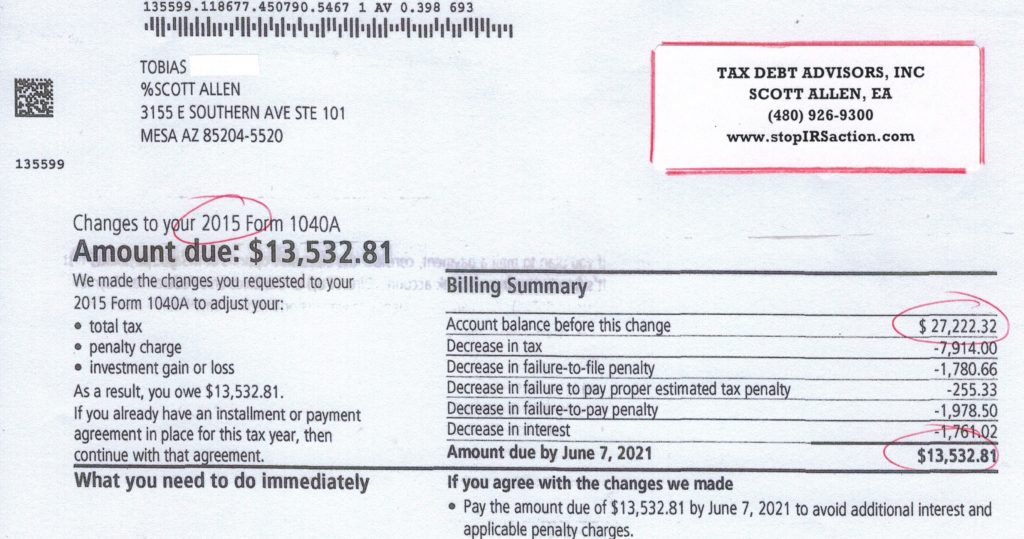

Scott Allen EA comes across these situations on a weekly basis. His tax practice was founded on specializing in filing Phoenix AZ back tax returns in getting the returns prepared as aggressively as possible within the law. Whether you are an employee, self employed, in real estate, or deal heavily in the stock market Scott Allen EA is experienced to take on your income tax filings.

Tax Debt Advisors serves the greater Phoenix AZ area in tax preparation and IRS settlement needs. He strongly recommends that you meet and consult with your potential IRS representative face to face whether you decide to hire Scott or not. That is the surest way to finding the right person for you.

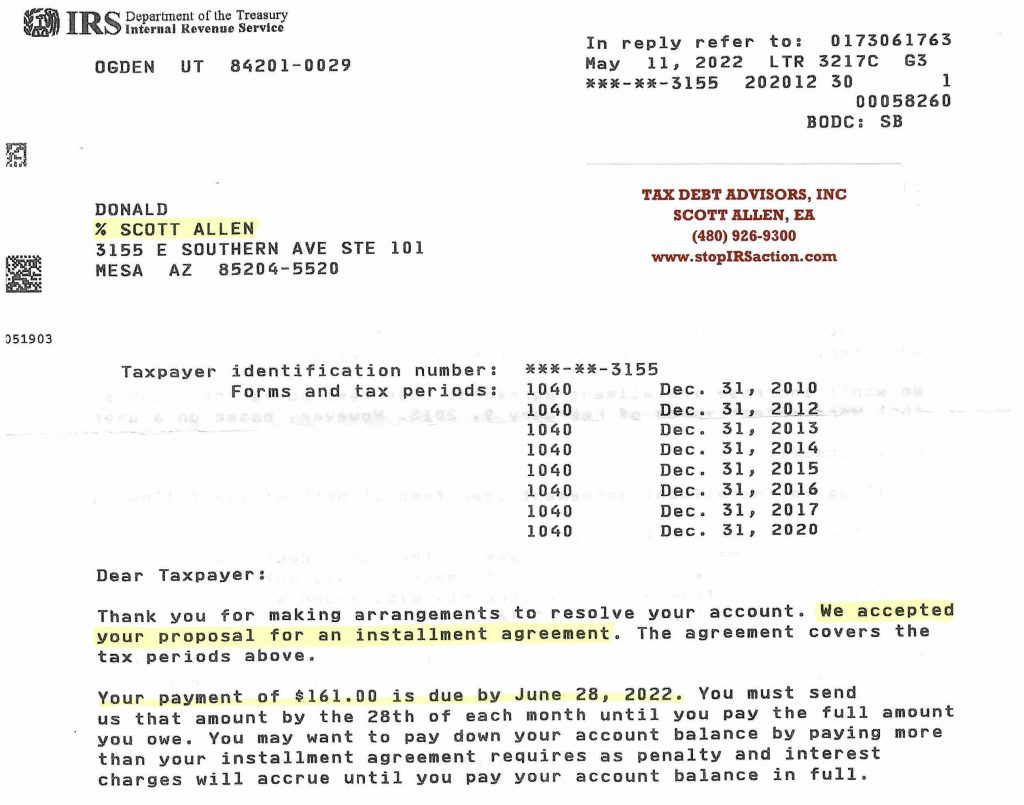

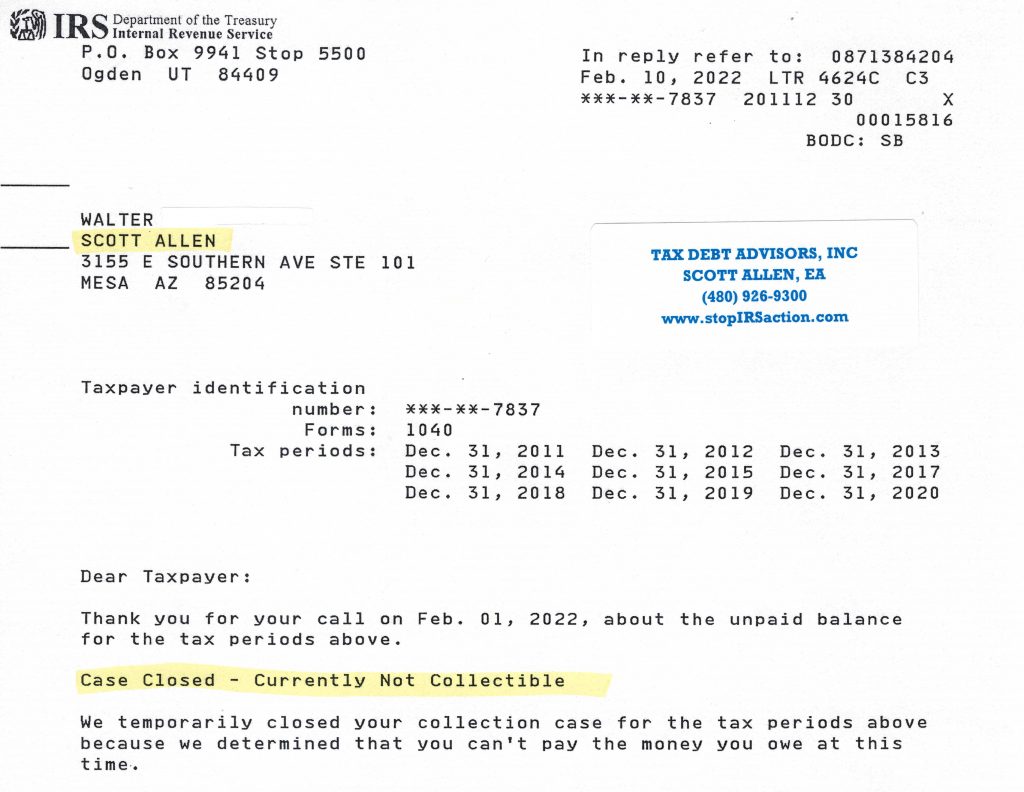

Click here to see other successful results Scott Allen EA has completed for his clients.