We are Mesa Arizona’s Top IRS Problems Solvers to Minimize IRS Tax Debt on Back Taxes

Mesa Arizona’s Top IRS Problem Solvers

The reason that a correct return will minimize the IRS tax debt is that the IRS is unaware of what you are entitled to deduct on your return. This would include but is not limited to the following:

Contact Scott Allen E.A. if you have delinquent tax returns as soon as possible. Now is the time to act and Scott Allen E.A. is the right choice. Tax Debt Advisors, Inc. offers a free initial consultation for Arizona taxpayers. Meet personally with him by calling 480-926-9300.

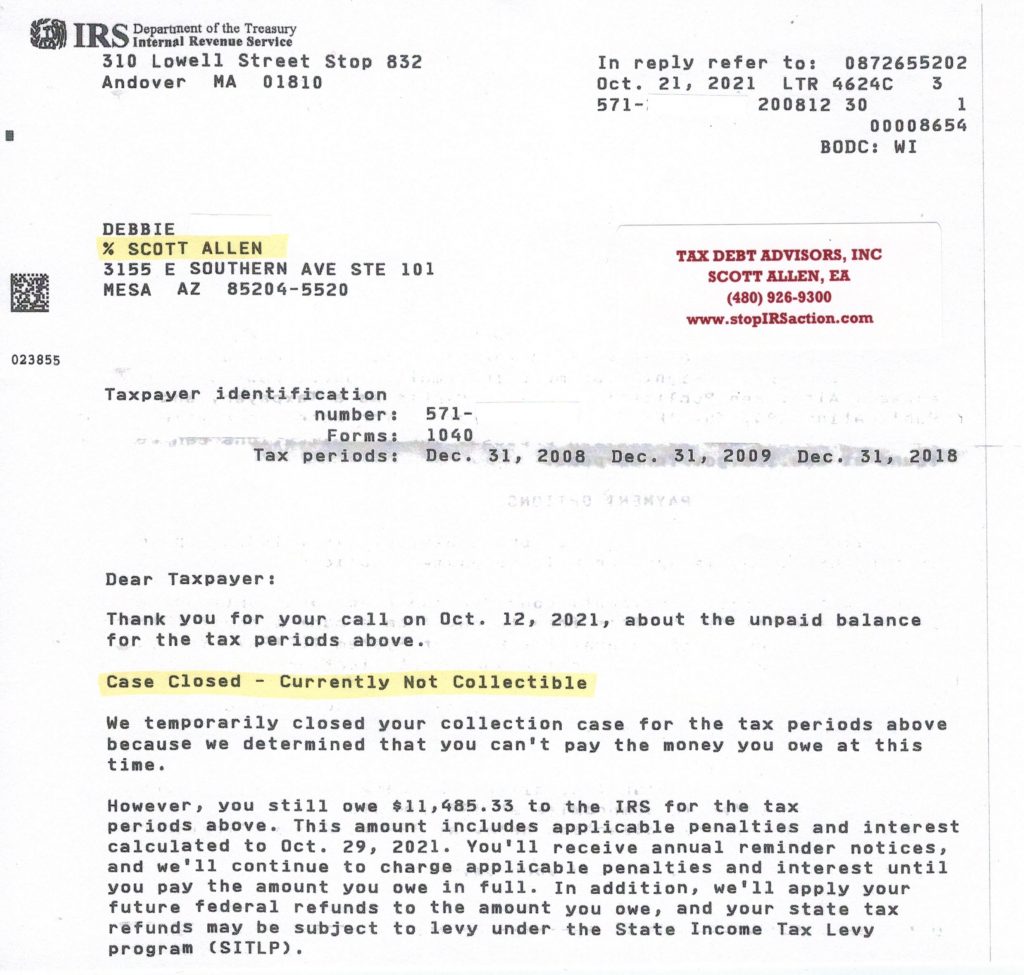

Debbie was a taxpayer who met with Tax Debt Advisor’s Inc – Mesa Arizona’s top IRS problem solvers. They were able to get the old and newer IRS debt negotiated into a currently not collectible status (CNC). Her debts from 2008 & 2009 will expire soon so it is just a matter to letting the clock run out on those. With her CNC status the IRS cannot pursue any collection activity against her. Job well done! (see notice below)