Mesa IRS Problems

Mesa IRS Problems solved in 2017

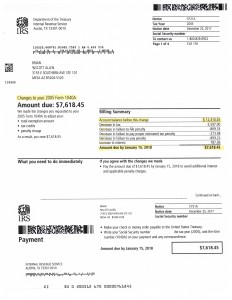

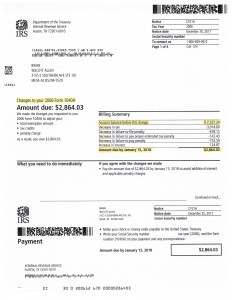

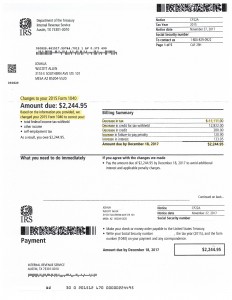

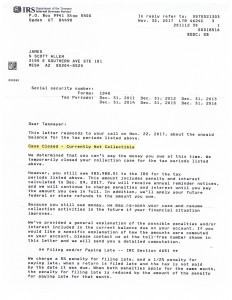

Brian had himself some serious Mesa IRS problems that needed some solving. He met with Tax Debt Advisors about six weeks ago to discuss his situation. Not only had he not filed any tax returns for about 11 years but the IRS filed his 2005 and 2006 tax returns for him giving him improper deductions and expenses. As you can see from the notices below this caused a large tax burden. Through a complete examination of his account and pulling the IRS records, information was gathered to prepare these two years properly. We filed them with the IRS department that handles these cases and got the IRS to lower his tax debt by $9,255. This is a substantial savings for him. The best part of it all is that it really isn’t too much effort or expense to prepare SFR protest tax returns. In addition to protesting these two years, Tax Debt Advisors also prepared the rest of the required missing tax returns current through 2016.

If you believe you have incorrect balances owed to the IRS because they filed tax returns in your behalf contact Tax Debt Advisors today to speak with Scott Allen EA. He is an expert in representing taxpayers as their IRS power of attorney and preparing any and all back tax returns. Scott Allen EA will break the process towards resolution into about three different steps. Breaking the process down simply is key to being sure the client understand the work being done and most importantly what they are paying for. Evaluate your options with the IRS today. Call now.