2018 Gilbert IRS Settlement by Scott Allen EA

2018 Gilbert IRS Settlement

If you came across this blog you are probably in some type of tax trouble which may require a 2018 Gilbert IRS settlement for you. Tax trouble could mean a number of different things. Some taxpayers meet with Tax Debt Advisors just for a consult. Others are under an IRS wage garnishment. Some have back tax returns that need to be filed. In any case, the ultimate goal is to get some type of Gilbert IRS settlement. Tax Debt Advisors is a local family owned company that focuses on solving simple to complex IRS problems by representing them as their Power of Attorney.

Let’s give you an example. George and his wife met with Tax Debt Advisors a few months ago. They currently did not owe any back taxes to the IRS however they were behind on their tax filings for 2015, 2016, and 2017. Both of them were employed as W2 wage earners. They were having some taxes being withheld from their paychecks but not enough. An IRS Power of Attorney was signed and Scott Allen EA began investigating their case. He was able to verify any and all compliance issues, and retrieve and confirm all documents the IRS had on record for both taxpayers for the three years that needed to be prepared. Upon reviewing the information with the taxpayers and confirming that all information was correct, the returns were prepared and filed properly. Back tax returns can typically take anywhere from four to eight weeks for processing. While waiting for those to be completed Scott Allen EA helped the taxpayers prepare and organize their current financial information so that they could evaluate all settlement options available.

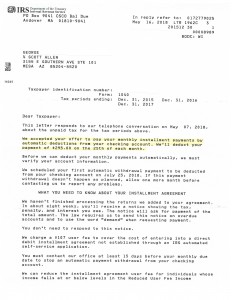

Below is what was successfully accomplished for George. All his back tax debt from 2015, 2016, and 2017 was settled into one monthly payment plan. The payment plan was negotiated in a way that prevented the IRS from filing a federal tax lien against their credit. As long as George remains in compliance with his future tax obligations the IRS will no longer bug him again.

If you might be in a similar situation as George and/or trying to avoid a tax lien from being filed, speak with Scott Allen EA on the phone today. He will put your mind at ease.