Mesa IRS Currently Non Collectible

Case Closed – Accepted Mesa IRS Currently Non Collectible

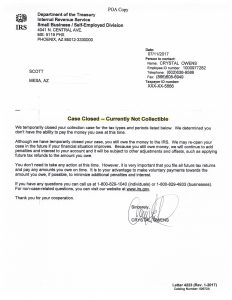

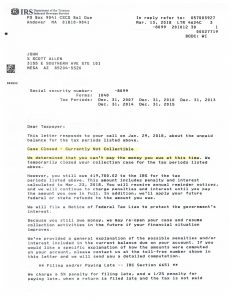

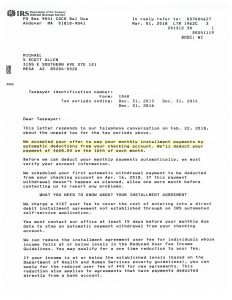

A tax client named Scott received an approval for a Mesa IRS Currently Non Collectible status on his back tax debt. Scott and his wife were about six years behind on their tax filings. They made an appointment to meet with Tax Debt Advisors to discuss how they could assist. Tax Debt Advisors was able to represent the concerned taxpayers before the IRS and put a hold to further enforcement action. All the back tax returns were prepared one at a time until brought current. Scott is self employed so with no taxes being withheld they owed for each and every year. However, based upon their current financial status the taxpayers qualified for a currently non collectible status on all the back tax years. You can read into more about this status by clicking here. In addition you can read the acceptance/approval letter from the IRS agent below. These are always good IRS letter to open up to say the least.

All the client needs to do is to file and pay on time their future tax obligations and they will remain in this status. If they do not then it will cause a default and they will have to rework a new agreement. If that happens they may or may not qualify for the same agreement if their financial situation has changed. What if the taxpayers are making $800 more per month then they were when the agreement was established? Now the IRS could force them to agree to an $800 a month payment plan. This is something you do not want to happen. Again, the key to keeping the IRS “off your back” is to remain in filing compliance. Far too often clients will become repeat clients because they cannot correct the problem.

Rather then becoming a repeat client, do it right the first time with Scott Allen EA of Tax Debt Advisors in Mesa AZ. Speak with him today regarding your IRS matter.