Call Tax Debt Advisors if you receive a Federal Tax Levy

Mesa AZ Federal Tax Levy Help

A Mesa AZ federal tax levy can take your wages, state refunds and your bank accounts. The levy will end when the IRS issues a levy release, or you have paid your IRS tax liability, or the statute of limitations expires for legally collecting the IRS tax liability.

If the IRS issues a Mesa Arizona levy against your bank accounts, the bank puts your funds on hold up to the amount you owe the IRS for a period of 21 days. This allows you time to work out any issues before the bank is required to send the funds to the IRS. If you incur bank charges as a result of a mistake made by the IRS, you are entitled to have the IRS reimburse you.

If you are under the burden of a federal tax levy in Mesa AZ, seek out professional help immediately. Scott Allen E.A. of Tax Debt Advisors has the expertise to minimize the damage a Mesa AZ federal levy can wreck on your personal finances. If you would like a free initial consultation, call 480-926-9300 to schedule an appointment.

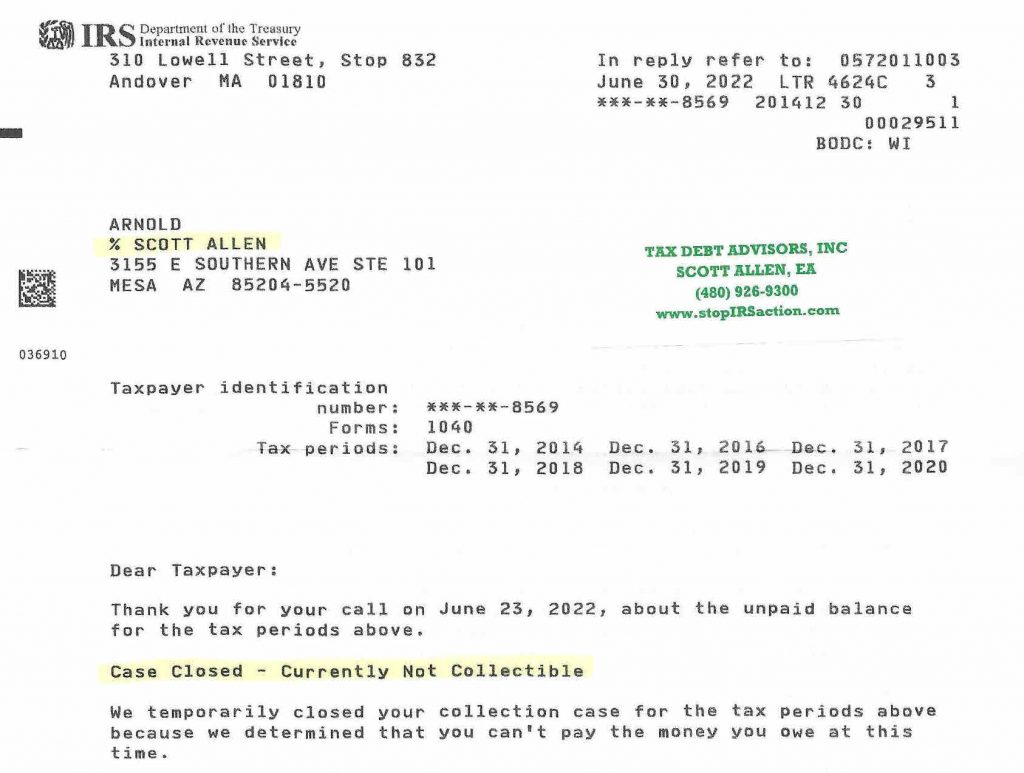

Arnold got his Mesa AZ federal tax levy stopped with a currently non collectible status negotiation by Scott Allen EA. All six years that he owed the IRS for was put into this status. For the time being he does not have to make any payments on his back taxes owed. What a great relief this was for Arnold.

0