Abate IRS Taxes Mesa

Abate IRS Taxes Mesa today

You may be bale to abate IRS taxes Mesa as well. Firstly, everyone thinks that everyone can abate back taxes, interest, and/or penalties. The truth (I may be the only one to say this) is most people don’t. But for those that do it is a terrific option.

What avenues are there to abate IRS taxes? Below is a list of a few.

- File and IRS Offer in Compromise

- File for an audit reconsideration

- File a form 843 to eliminate incorrect penalties

- File a corrected tax return against an IRS “SFR return”

- Prepare and file an amended tax return

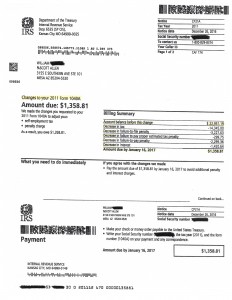

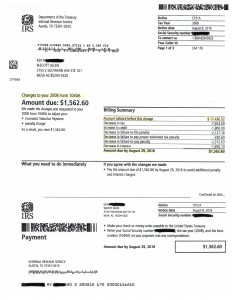

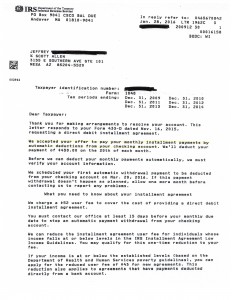

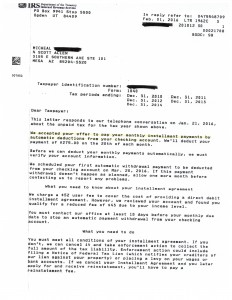

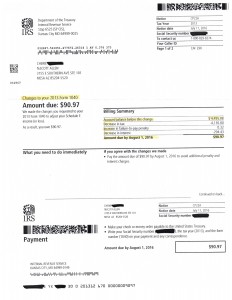

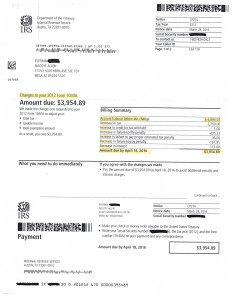

For William (A client of Tax Debt Advisors in Mesa) he qualified to file a corrected tax return against an IRS “SFR return”. This is exactly what they did for him. The final result: a tax savings of $21,593. View the notice below. This is just one of thousands of successful results by Tax Debt Advisors.