Stop IRS levy in Glendale AZ

Do you need a stop IRS levy in Glendale AZ?

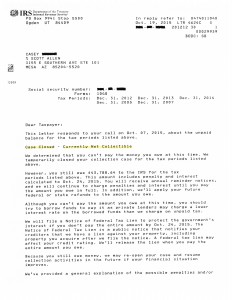

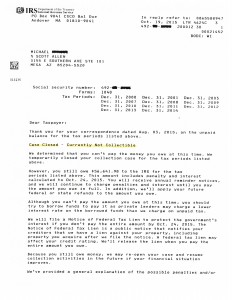

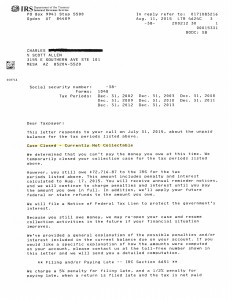

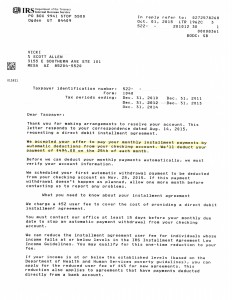

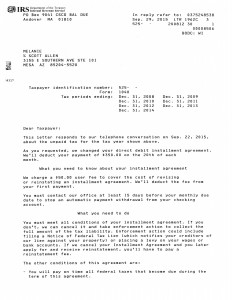

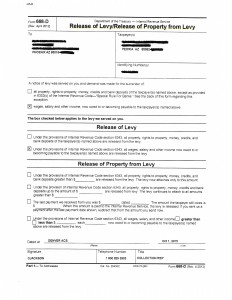

If so, you are not the only one. Manuel came to see Tax Debt Advisors was was under a levy threat, had not filed tax returns in 10 years, and didnt know how to begin. Long story short, Tax Debt Advisors was able to stop levy action, file the required missing tax returns, and work out a settlement for him on the remaining amount owed after all the work was completed. Click on the letter below to see the actual settlement Tax Debt Advisors worked out for Manuel.

Don’t let yourself become a victim of the IRS requiring a stop IRS levy in Glendale AZ to be done. Hire a responsible professional to contact the IRS first. Doing so will allow you to get back in compliance with the IRS in a more efficient matter on a reasonable time table rather then on the IRS’s terms. Scott Allen EA of Tax Debt Advisors knows how to handle your back tax problem from beginning to end. Let his experience go to work for you. Since 1977 his company has settled over 108,000 IRS debts. That is a lot of work day in and day out. Scott Allen EA will meet with you for a free initial consultation. Call him at 480-926-9300. He is local and only works local cases; this allows him to be successful with every case he takes on. Be leery of promises made by salespersons from out-of-state companies. If it sounds too good to be true it probably is.