Enrolled Agent vs Mesa AZ IRS Tax Attorney

Enrolled Agent or a Mesa AZ IRS Tax Attorney for IRS Relief?

Many struggling taxpayers are under the assumption that their IRS problem is severe enough to require hiring a Mesa AZ IRS Tax Attorney. However a Mesa AZ IRS tax attorney is only required in criminal or fraudulent cases which is in less then 2% of IRS problems. If you are going thru a random audit, have back tax returns to file, or owe the IRS more then you can pay back the good news is that none of these situations are of a criminal nature. Take a deep breath because your situation is only delinquent. Scott Allen is a licensed Mesa AZ Enrolled Agent specifically licensed to handle delinquent taxpayer situations. As your IRS Power of Attorney he can represent you before the Internal Revenue Service. Under his watch and directions you will not be levied, garnished or summons.

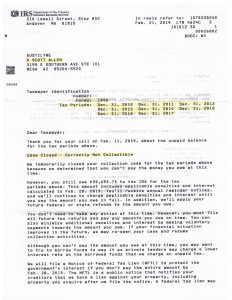

Scott Allen EA wanted to share with you a recent success he had with a client this year. By challenging an audit the IRS placed on a client for his 2010 tax return nearly $60,000 in taxes, interest, and penalties were reduced. A copy of the approval notice from the IRS is below for your viewing. An expensive Mesa AZ IRS Tax Attorney was not needed to get this done. Rather finding the right person with the right relationships with IRS personal acting in a timely matter is what’s required.

If you live near Mesa Arizona meet with Scott Allen EA today for a free evaluation of your tax matter. Click here to be transferred to his contact page or better yet call him at 480-926-9300 and speak with him as your FIRST before hiring an expensive (and often unnecessary) Mesa AZ IRS Tax Attorney.

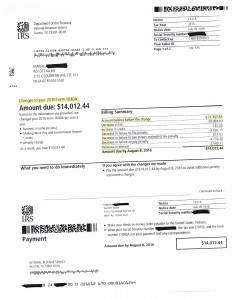

February 2019 Case Update:

Check out the completed settlement by Scott Allen EA for his client. She was under a wage garnishment for her back tax debt and needed relief being on a modest fixed income.

Scott Allen EA was able to negotiate a currently non collectible status for this taxpayer. Many taxpayers believe only a Mesa AZ IRS tax attorney can stop a garnishment by the IRS. That is not true. If you are worried about a current or future IRS wage garnishment or bank levy consult with Scott Allen EA today. He can represent you by being your Power of Attorney before the IRS, preparing or amending any tax return filings, and negotiate the best settlement allowable by law.