Get a payment plan to settle IRS debt in Chandler AZ

Can you settle IRS debt in Chandler AZ like Nancy did?

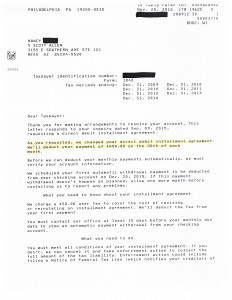

The best part of the payment plan agreement negotiated by Tax Debt Advisors Inc for Nancy is that the IRS will NOT file a federal tax lien. More often then not the IRS will typically a lien with the local county to protect their interest in case of a default or sell of an asset. For Nancy this is not the case. She is currently on a $450 a month payment plan to resolve her delinquent tax situation. To see her settlement agreement view the document below.

What is required to prevent an IRS tax lien from being filed? Some of the requirements are the your total tax liability needs to be less then $50,000. The other main component is to negotiate the debt to be paid through a direct debit out of a bank account. This program is part of the “fresh start” they instituted about five years ago to give delinquent taxpayers some relief. The benefits of not having a tax lien filed against you comes handy when a taxpayers wants to purchase a car or home. For some occupations its important to not have a tax lien to keep their employment.

To see if you are a candidate to get an IRS payment negotiated without a tax lien filed against your credit set up an appointment with Tax Debt Advisors Inc near Chandler AZ today. Not only will he go over different payment plan options but will help you evaluate all available options to get the IRS off your back.

Tax Debt Advisors Inc is located near central Mesa AZ at 3155 E Southern Ave #101 Mesa, AZ 85204