I need IRS HELP: IRS Tax Attorney in Mesa AZ: Yes or No?

No, IRS help is not a legal matter. Here are some suggestions on what to look for in choosing an IRS representative:

- You should be entitled to an initial free consultation. At this meeting the person you meet with must be the one who will represent you—NOT A SALESMAN!

- You should feel that all of your questions are answered in a manner you understand. If you do not understand the answers you are getting, you a probably dealing with someone who is not honest.

- Make sure the person handling your case can start immediately. Time is of the essence. Sometimes a delay of a few hours can make a big difference in the work needed to be done and settlement options that are available.

- Make sure your IRS representative is licensed in all 50 States.

- Make sure you have the direct dial to your IRS representative and that he or she will be the only one you talk to about your IRS problem.

- Work only with a firm that presents all of your IRS settlement options; not just the one they want you to accept.

- Make sure you are quoted a flat fee for the work done. Not a large upfront fee – but a quote of the the total costs of the process. That will also require you to respond timely to the needs of your IRS representative.

Scott Allen E.A. (who is not an attorney) will provide his services in accordance to these recommendations. Scott is available for a free consultation at 480-926-9300. His firm has been serving clients with tax problems since 1977 and has successfully resolved over 114,000 IRS tax debts.

Before you make the decision to hire an IRS tax attorney in Mesa AZ for your IRS help please take 10 minutes and call me for a second opinion. I can usually meet with you for a free consultation the same day you call – if necessary.

Thanks for considering me as your IRS problem option. Make today a great day for you!

Office: 3155 E Southern Ave Ste 101 Mesa, AZ 85204

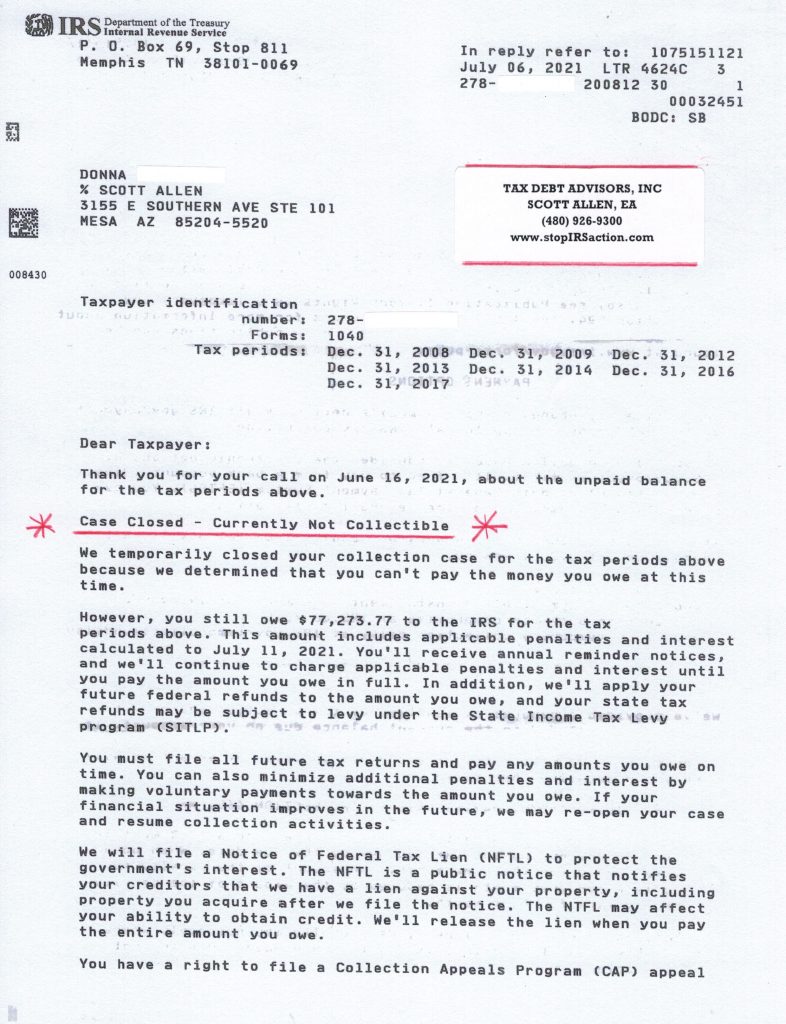

Donna hired Scott Allen E.A instead of using an IRS tax attorney in Mesa AZ and was not disappointed one bit. As you can view from the letter below she was able to get all seven of her IRS debts into a currently not collectible status. Wow, what a relief! Feel free to give Scott a call if you would like to learn more about this settlement option. Currently not collectible status is just one of several options to resolve and IRS debt issue.