File back taxes Phoenix AZ and get a refund!

Wake up and file back taxes Phoenix AZ

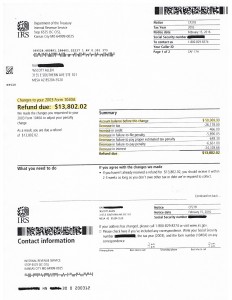

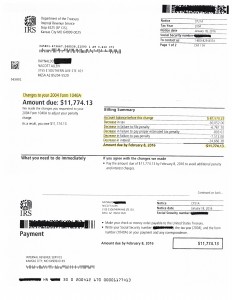

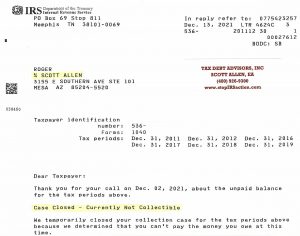

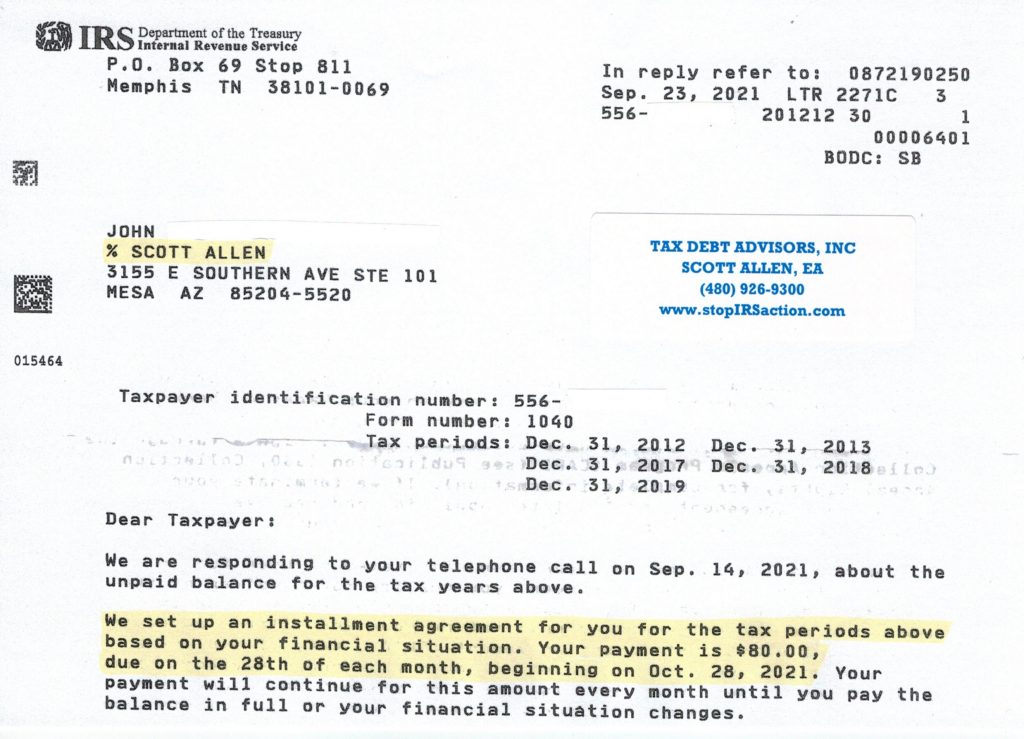

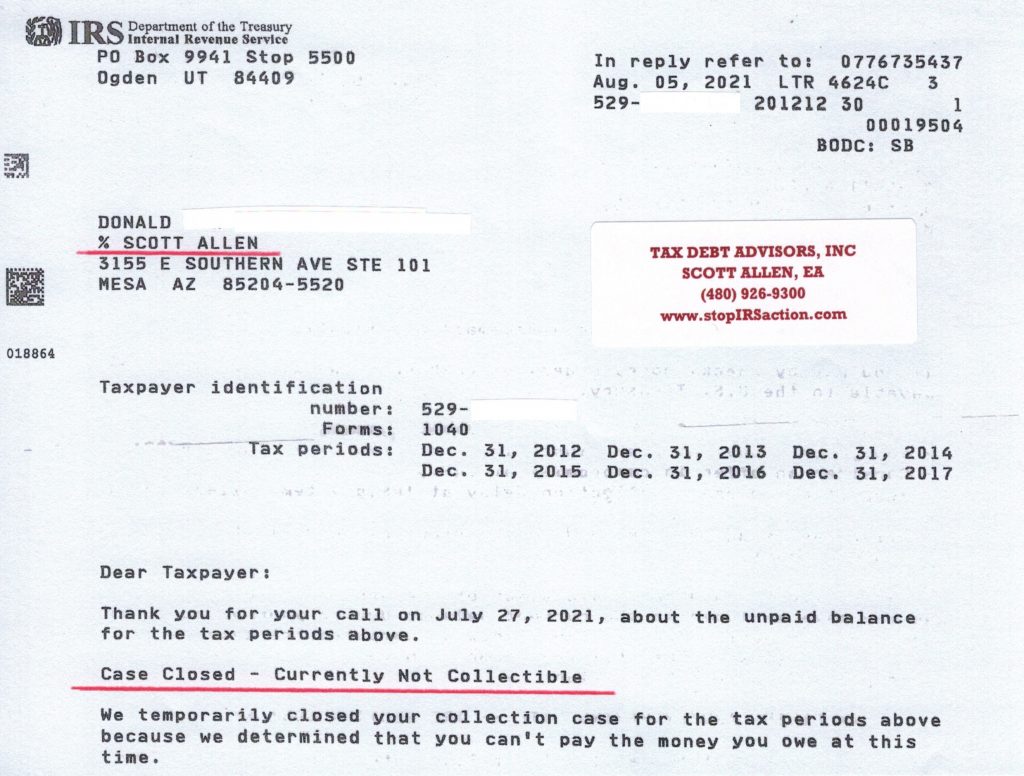

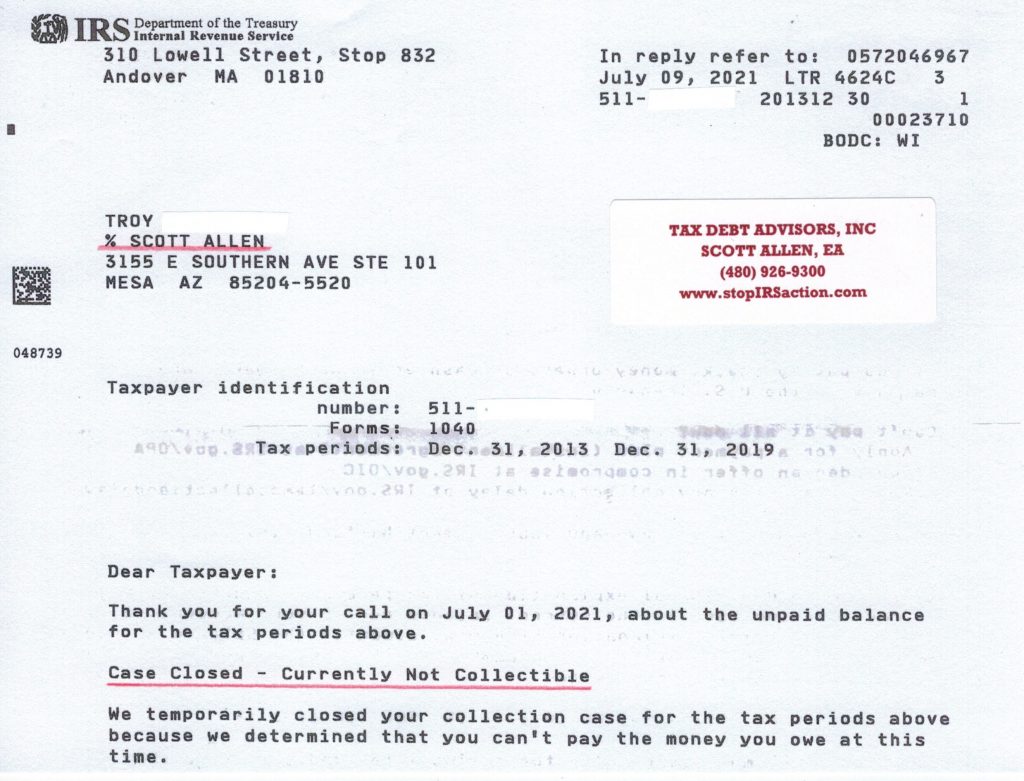

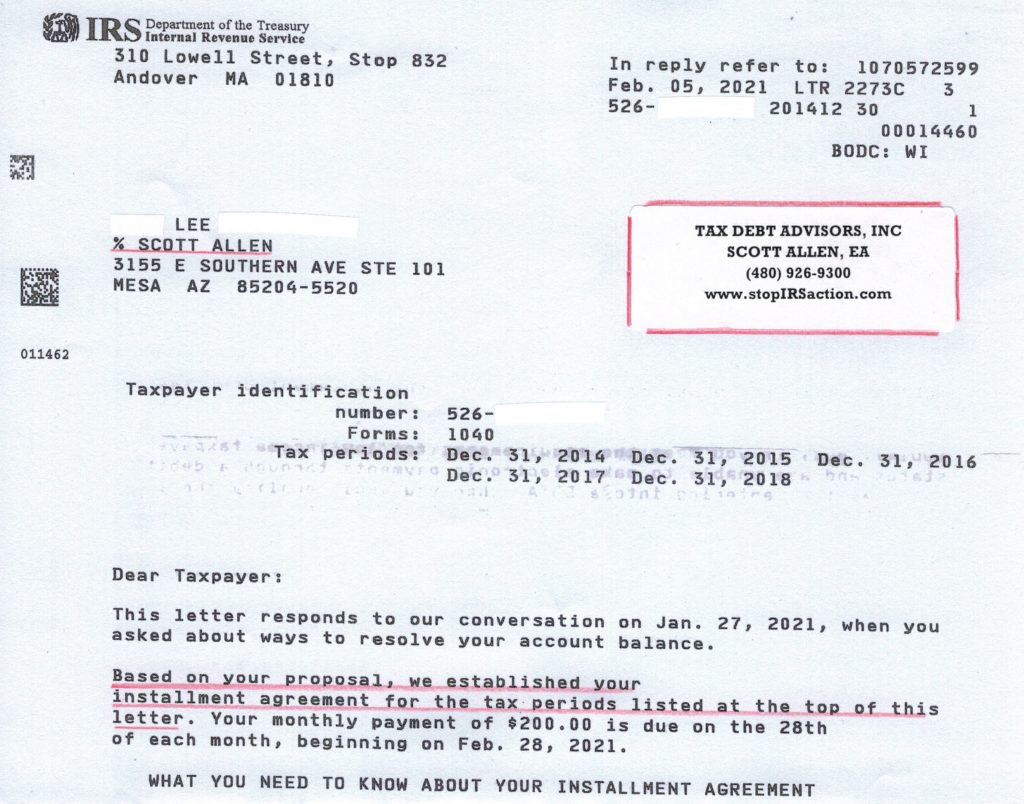

Chances are what you are thinking about your situation is a lot worse then the actual reality of it. To file back taxes Phoenix AZ you simply just need to face the matter. Delaying it any longer will not make it go away. The good news is that Scott Allen EA has never come across a case that was actually worse then what the client was thinking. 95% of the time its actually not as bad as what the client was expecting. The same is probably true for you as well. Just take a close look at the notice below. The taxpayer was getting garnished by the IRS on an unknown tax bill for 2003. He contacted Scott Allen EA to stop the garnishment. Upon doing proper research it was determined that the tax return was filed by the IRS (not by the client) and that it could be aggressively protested. Upon the protest tax return getting filed and accepted by the IRS the IRS actually owed the client over $13,000.00. Would you continue to keep your head in the sand year after year if you knew this would be your outcome? Probably not.

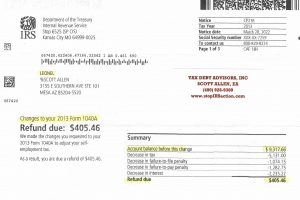

File Back Taxes Phoenix AZ: 2013 Tax Preparation

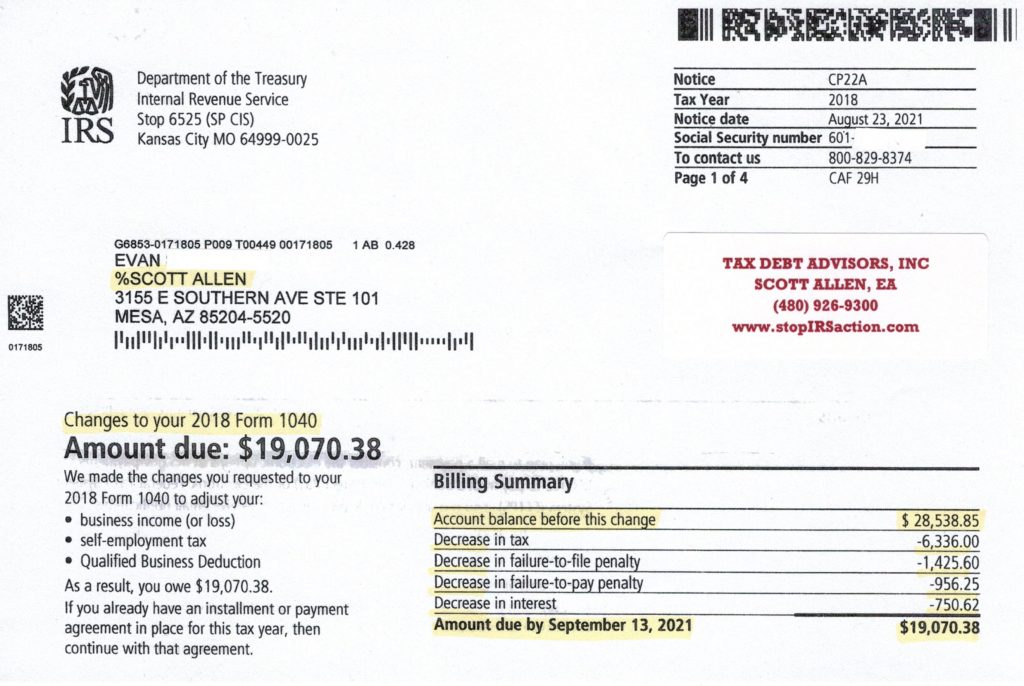

Who would think you could prepare and file back taxes Phoenix AZ for 2013 and have the IRS owe you money? Leonel did just that in 2022. Before filing the tax return the IRS made their own assessment for the tax year causing him to owe the IRS over $9,000. Upon meeting with Scott Allen EA he learned he could file a protest with the IRS and get it reduced with a proper tax return filing. Click on the IRS notice below. The IRS owed him $405!

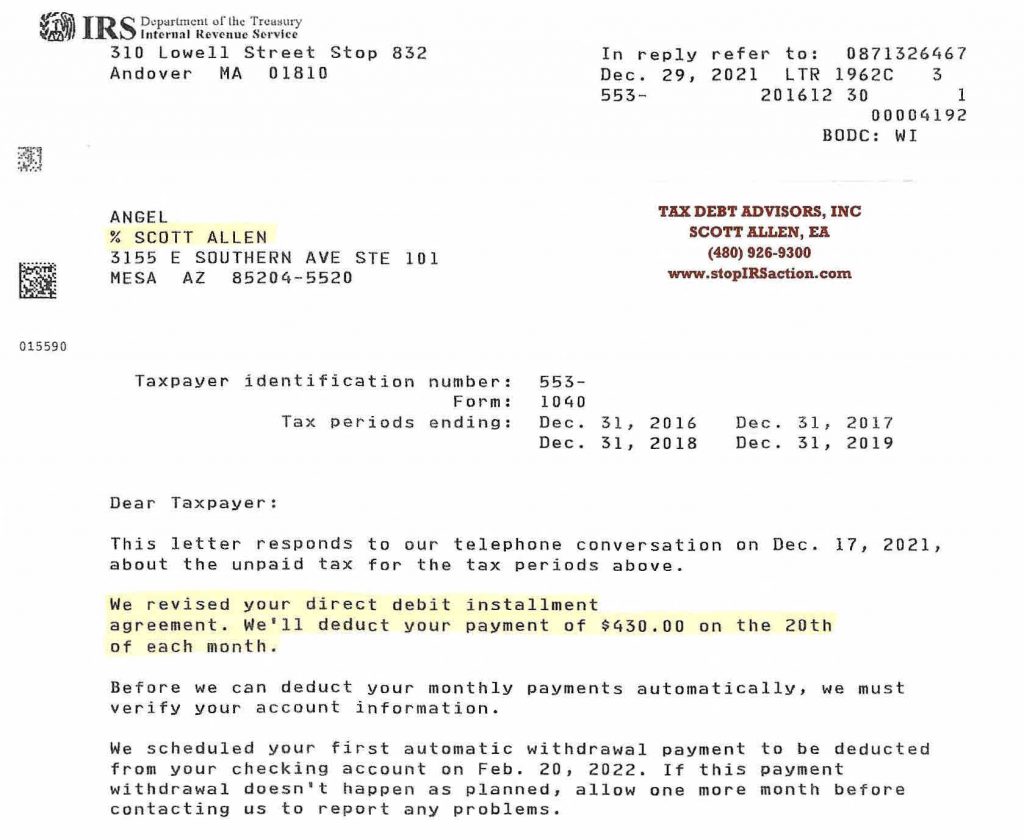

Talk with Scott Allen EA of Tax Debt Advisors today to discuss your case with him. He does not charge for any initial consultation. Together you can discover the best possible outcome for you!