IRS Levy—Everything you need to know before calling me for a free consultation.

What is an IRS levy?

A levy from the IRS is a legal seizure of your assets to pay off your tax debt. A levy differs from a lien. A lien is a legal claim against your assets. A levy actually takes the asset to satisfy the IRS tax debt.

When does the IRS levy?

An IRS levy will only take place after they have assess the tax and sent you a notice and demand for payment, and you neglect or refuse to pay the taxes owed, and they sent you a Final Notice of Intent to Levy and Notice of Your Right to A Hearing (levy notice).

The notice is considered received when it is given to you by an agent, when it is mailed to your home or place of business or sent to your last known address by certified or registered mail.

What should I do when I receive an IRS notice of levy?

If you have been working with an IRS revenue officer or agent, you can request to speak to their manager to review you case and explain your position. The next step would be to request a Collection Due Process Hearing with the Office of Appeals. This must be done within 30 days of the date of the notice.

What should I be prepared to do when I meet with the Office of Appeals?

If you have paid all the taxes, provide proof of payment. On occasion the IRS does apply tax payments to the wrong account or to the wrong type of tax or tax year.

If you are in bankruptcy when you receive the levy notice, your levy will be entitled to an automatic stay until you come out of bankruptcy.

If the IRS made an error in computing the tax owed, bring documentation that will show that the amount owed is less than the assessed balance.

If the IRS statute of limitations has passed, the levy will be considered null and void.

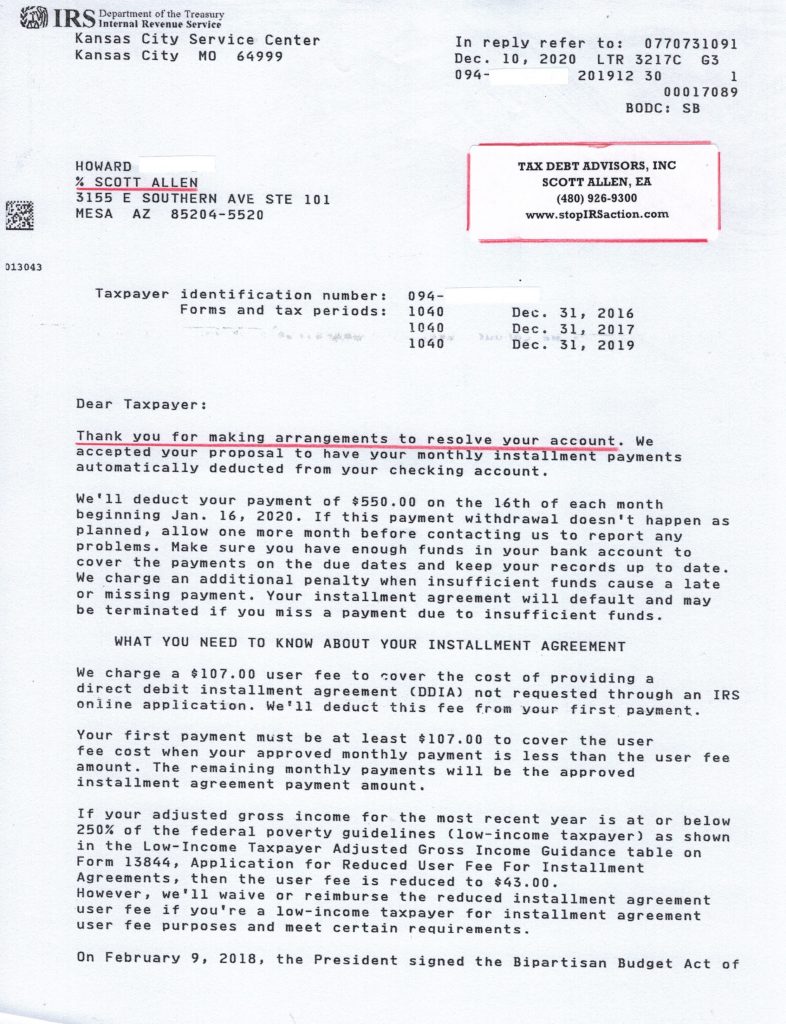

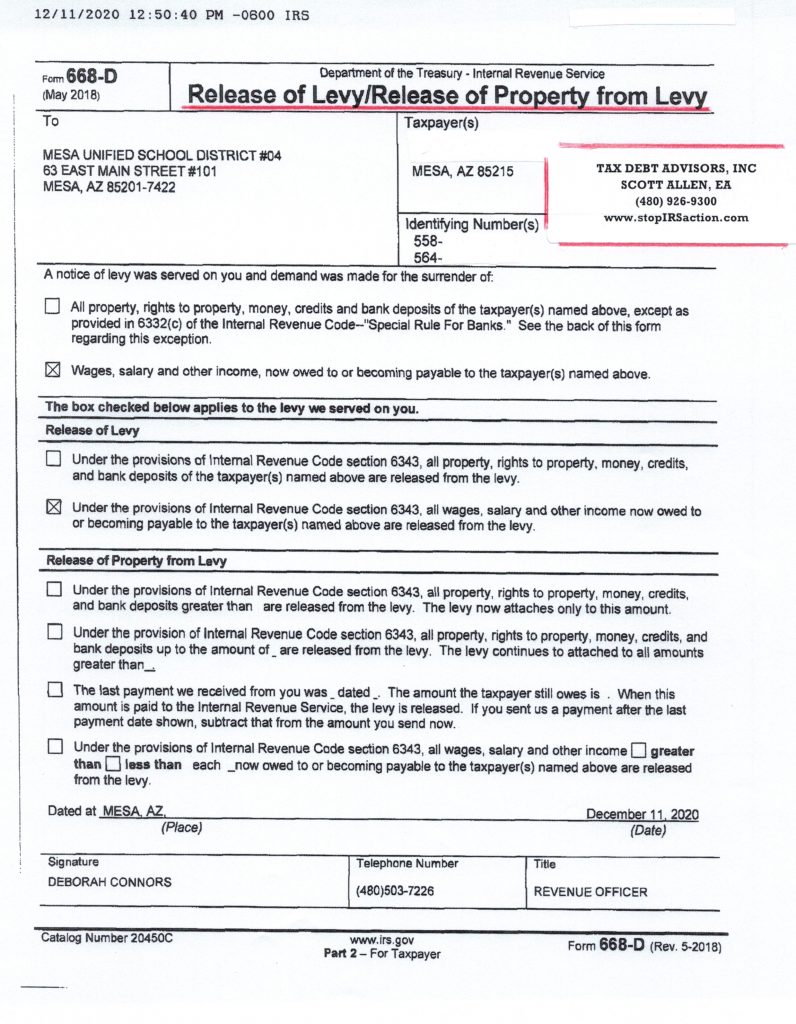

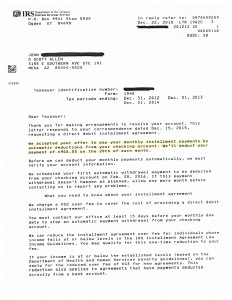

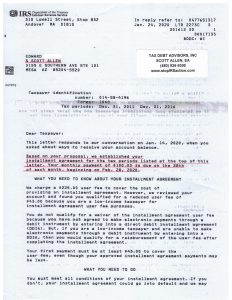

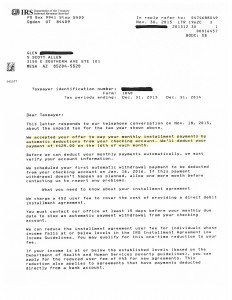

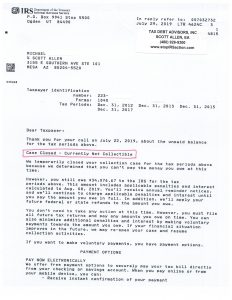

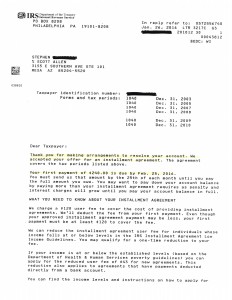

If you entered into a payment plan or some other collection option, the levy should be released pending proof that you have stayed in compliance with your tax filings and monthly installment arrangement.

If you feel that you are an innocent or injured spouse, provide proof of your reasons for seeking relief from the tax debt.

What if the IRS was wrong in levying my bank account?

You have 21 days to resolve your matter before funds are turned over to the IRS. If you paid bank charges due to an IRS error, you may be entitled to a reimbursement. You have 30 days to appeal your request to the Tax Court.

Can the IRS levy my state refunds?

Yes, under the State Income Tax Levy Program, the IRS may levy your state tax refund check.

Can the IRS levy my Social Security check?

Yes, the IRS can garnish up to 15% of your Social Security check through the Automated Federal Payment Levy Program (FPLP).

How can I help you resolve an IRS levy?

The key to getting the greatest benefit from a representative is to provide the requested information quickly and making sure all information requested is provided at the same time. One piece of information can hold up the levy release even though you have provided the other ninety-nine. Information needs to be complete—most delays are caused by clients who are sloppy in providing all of the information requested.

If you owe the amount that has been levied, it is doubtful that the IRS will refund the amount taken. The release will generally apply to any future amounts that would have been taken after the release is granted.

Make sure that you provide me with all of the facts. Clients sometimes selectively “forget” to mention items that they do not want to disclose or are embarrassed about. If you are uncomfortable providing all of the information needed to release you levy to your representative, you probably have the wrong person representing you or you are unwilling to face the realities of resolving your tax matter.

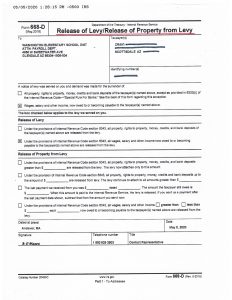

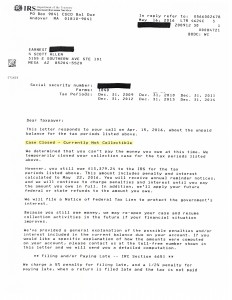

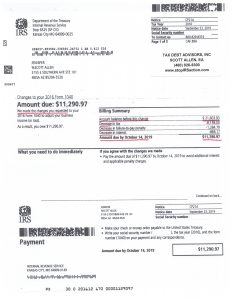

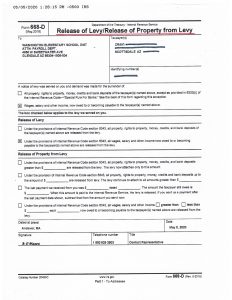

IRS levy In Arizona released

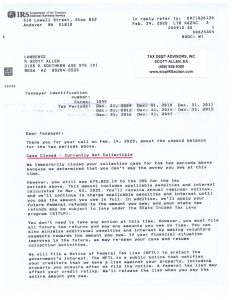

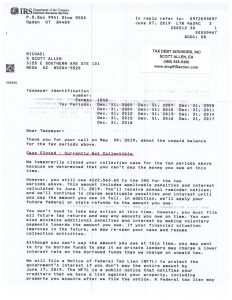

If you are currently being levied by the IRS whether it be your bank account or wages it can be stopped. Put Scott Allen EA onboard as your IRS power of attorney to represent you thru the process. See a recent IRS levy release accomplished (5/5/2020).

IRS Levy in Arizona

Tax Debt Advisors, Inc – Scott Allen, E.A.

IRS Levy in Arizona: IRS help from Tax Debt Advisors, Inc serving Phoenix, Mesa, Chandler, Gilbert, Tempe, Glendale, Peoria, and Queen Creek.