Who should do your Mesa AZ IRS payment plan?

Consider Scott Allen EA for your Mesa AZ IRS payment plan negotiation.

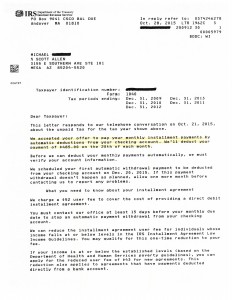

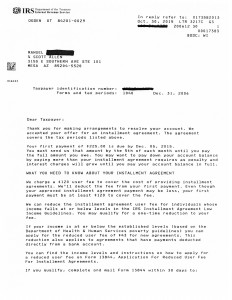

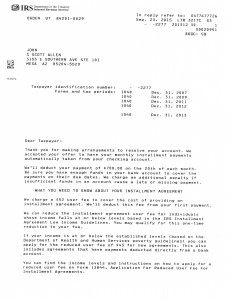

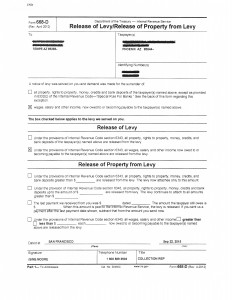

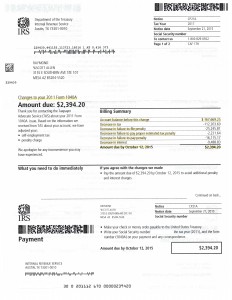

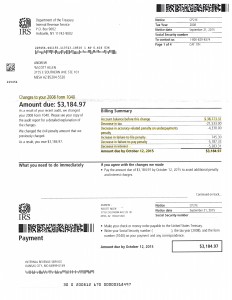

Scott Allen EA of Tax Debt Advisors has years of experience in dealing and negotiating with the IRS for payment plans and other various IRS settlement options. The picture below will show you the Mesa AZ IRS payment plan Scott Allen EA was able to negotiate for his client Michael.

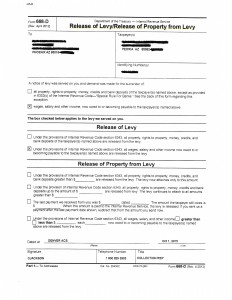

Michael’s IRS payment plan was able to incorporate all of his tax debt (as required by the IRS) and they were also able to prevent the IRS from filing a tax lien on his credit. The IRS will normally do this to establish payment plans as a way to secure the debt. By setting up the agreement in a way to comply with the IRS guidelines Scott Allen EA was able to prevent that from happening. This was crucial to the the client as he is in the beginning stages of buying a home and if an IRS tax lien hit is credit it would dramatically hurt his buying/borrowing potential.

As long as the taxpayer remains in compliance by not missing any monthly payments and not bringing on future IRS debt, the agreement will remain in effect. Most importantly, a tax lien will never be filed against the taxpayer.

If you think you might qualify for a similar scenario give Scott Allen EA a call. Has the IRS already filed a tax lien against you? There may be options available to you to get the IRS lien removed before your debt is paid in full.

Scott Allen EA’s contact information:

Phone: 480-926-9300

Address: 3155 E Southern Ave Suite 101 Mesa, AZ 85204

View some of his recent successes and Tax Debt Advisors Reviews by clicking here