2016 IRS help in Mesa AZ

Is it time for IRS help in Mesa AZ ?

Follow Joanne’s example by getting IRS help in Mesa AZ. Before contacting Tax Debt Advisors Joanne was facing a pending IRS lien and levy on her commission income. She heard about Tax Debt Advisors by googling local IRS help in Mesa AZ. Based upon her research she called and spoke with Scott Allen EA and scheduled a consultation.

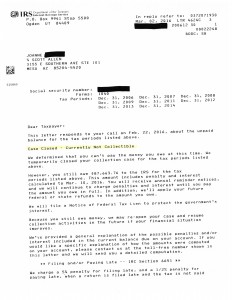

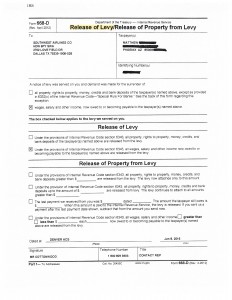

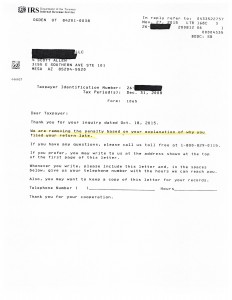

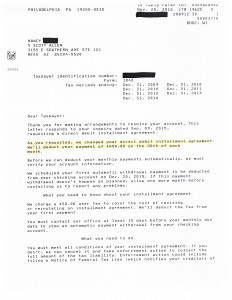

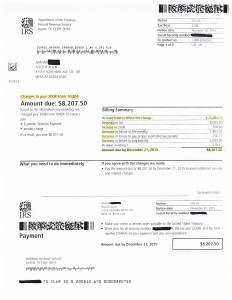

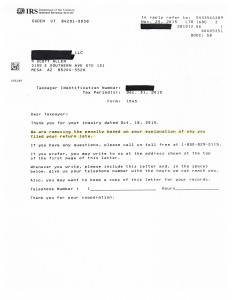

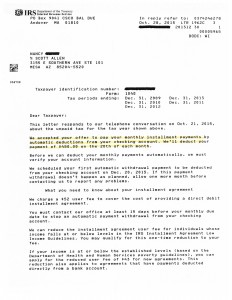

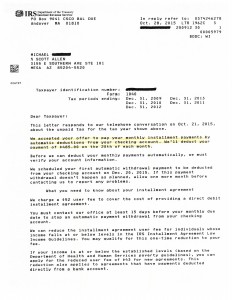

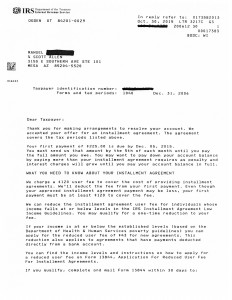

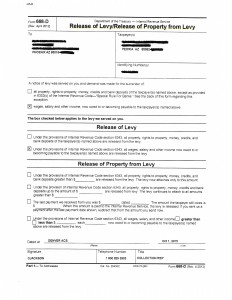

If you click and view the IRS notice above you will see exactly what Scott Allen EA was able to do for one of his clients. Joanne had four years of back taxes to file along with some other debt issues on the account. She had some equity in her primary residence that she wanted to sell without the IRS grabbing all of the equity. As her IRS power of attorney Scott was able to get the IRS to hold off on all collection activity for a long enough time to give the taxpayer time to sell her home (preventing a tax lien from being filed). Over about a two month time period Scott Allen EA also prepared the four missing tax returns. After getting Joanne in full compliance with the IRS Scott Allen EA aggressively negotiated a currently non collectible status on her IRS debt while she is trying to get her life back on track. She is a single mom living in the east valley and now the IRS is the least of her worries.

If you are behind on your taxes, being threatened by a lien of levy, or lost on where to begin give Scott Allen EA a call to schedule a free initial consultation to evaluate your best options. Do not make any quick or rash decisions without being aware of all the available options to you and your family.

Thank you.